ACCOUNTING CONCEPT OF DEPRECIATION :

Depreciable assets are assets which

– are expected to be used for more than one accounting period;

– have a limited useful life and

– are held by the organization for use in the production or supply of goods and services.

When a fixed asset is purchased, it is recorded in the books of accounts at its original cost. But, the fixed asset is used to earn revenues for a number of accounting periods in future with the same acquisition cost until the concerned fixed asset is sold or discarded. It is therefore, necessary that a part of the acquisition cost of the fixed asset is treated or allocated as an expense in each of the accounting periods in which the asset is used. This allocation of cost in the form of an expense is known as depreciation in accounting.

Suppose, a business purchases a machinery for Rs. 10,00,000 and after using it for five years, it is sold for Rs. 2,00,000. The cost of the machinery used in the business is Rs. 8,00,000 (Rs. 10,00,000 – Rs. 2,00,000). This cost must be allocated as an expense of the business at the rate of Rs. 1,60,000 (8,00,000 ÷ 5 ) for each of five accounting periods in which the machinery has been used to earn revenues. This Rs. 1,60,000 charge as expense is called accounting concept of depreciation.

It is the cost for the services obtained from the use of the asset in the same manner as the cost of wages, rent, etc. Depreciation is the expense charged to profit and loss account before arriving at the net profit for the year. In other words, the cost of fixed asset in the form of depreciation has to be matched against the revenues of the years over which the asset is used.

Thus, in accounting, depreciation means apportionment or allocation of the cost of the fixed asset over its useful life. Its aim is to spread over and allocate or distribute the cost of the fixed asset to the years of its use and charge the depreciable cost to profit and loss account before arriving at the profits of each of the accounting periods in which the fixed asset utilized.

Purpose of Depreciation Accounting: The primary purpose of depreciation accounting is cost allocation. Provision for depreciation in the profit and loss account does not involve the outflow of cash and hence funds to the extent of depreciation charged over the years will remain in the business and these funds can be easily used for replacement of asset.

JOURNAL ENTRIES

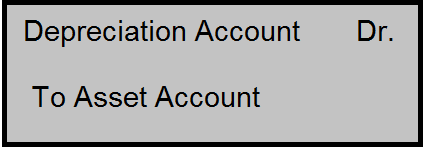

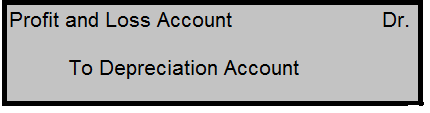

(1) WHEN THE DEPRECIATION IS DIRECTLY CHARGED TO ASSET ACCOUNT:

The asset account in this case appears at its reduced value in the balance sheet i.e.

Cost or book value XXX

Less: Depreciation for the accounting period. XXX

Depreciation expense is transferred to the debit of profit and loss account.

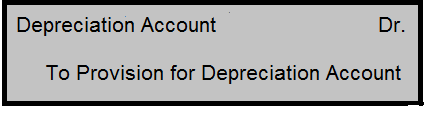

(2) WHEN PROVISION FOR DEPRECIATION ACCOUNT IS OPENED:

For charging depreciation:

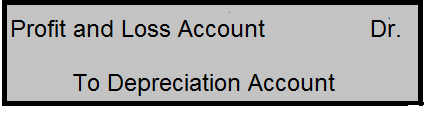

For transferring depreciation expense to Profit and Loss Account:

In this method, the asset account is not affected by the amount of depreciation and the value of asset appears in the ledger and the balance sheet at its original cost. The amount of depreciation written off is accumulated in provision for depreciation account.

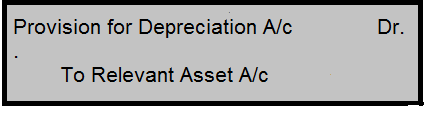

When the asset is sold or discarded or exchanged for a new asset, the total accumulated depreciation for that asset in the provision for depreciation account is transferred to that asset account by the following journal entry.

Thus, the balance in the provision for depreciation account always shows the accumulated depreciation on the assets which are in use or not sold out.

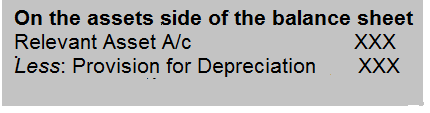

In the balance sheet, the asset account is shown at its original cost less balance in the provision for depreciation account.

Alternatively, the asset account can be shown at its original cost on the assets side and provision for depreciation account can be shown on the liabilities side. But the former method is better and recommended.