Recovery of duties not levied or not paid or short-levied or short-paid or erroneously refunded [Section 11A]:

In accordance with the principles of natural justice the central excise law rightly provides that before any action is taken against an assessee he must be given reasonable opportunity of presenting his case. One such situation would be that relating to the demand of duty not paid, short paid or erroneously refunded.

The show cause notice is invariably issued if the department contemplates any action prejudicial to the assessee. Thus, if on account of an infraction of the provisions of the central excise law it is considered appropriate to penalise the defaulter, it is necessary to first issue a show cause notice. The show cause notice would detail the provisions of law allegedly violated and ask the noticee to show cause why action should not be initiated against him. Thus, a show cause notice gives the noticee the opportunity to present his case.

The provisions of section 11A are discussed below:

(1) Cases other than fraud, collusion etc.

Where any excise duty:-

(a) has not been levied

(b) has not been paid

(c) has been short-levied

(d) has been short-paid

(e) has been erroneously refunded

for any reason, other than the reason of:-

- fraud

- collusion

- any wilful mis-statement

- suppression of facts

- contravention of any of the provisions of this Act or of the rules made thereunder with intent to evade payment of duty,

the following provisions become applicable:-

(a) Issuance of SCN within ONE year: Central Excise Officer shall, within one year from the relevant date, serve notice on the person chargeable with the duty which has not been so levied or paid or which has been so short -levied or short-paid or to whom the refund has erroneously been made, requiring him to show cause why he should not pay the amount specified in the notice [Clause (a) of sub-section (1)].

Period of stay to be excluded: For this purpose, where the service of the notice is stayed by an order of a court or tribunal, the period of such stay shall be excluded in computing the aforesaid period of one year [Sub-section (8)].

(b) Voluntary payment of excise duty and interest before issue of show cause notice (SCN): The person chargeable with duty may, before service of the show cause notice, pay on the basis of—

(i) his own ascertainment of such duty; or

(ii) the duty ascertained by the Central Excise Officer, the amount of duty along with interest payable thereon under section 11AA [Clause (b) of sub-section (1)].

(c) Written intimation to the Central Excise Officer of such voluntary payment : The person, who has so paid the duty voluntarily, shall inform the Central Excise Officer of such payment in writing.

(d) No SCN would be issued if amount paid in full: Central Excise Officer, on receipt of such information, shall not serve any show cause notice in respect of the duty so paid/any penalty leviable under the provisions of this Act or the rules made thereunder [Sub-section (2)].

(e) SCN may be issued for recovery if amount is short paid: Where the Central Excise Officer is of the opinion that the amount so paid falls short of the amount actually payable, then, he shall proceed to issue the show cause notice in respect of such amount which falls short of the amount actually payable in the manner specified under subsection (1) and the period of one year shall be computed from the date of receipt of information of payment (i.e. written intimation sent by the person making voluntary payment) [Sub-section (3)].

(2) CASES OF FRAUD, COLLUSION ETC.

Where any excise duty:-

(a) has not been levied

(b) has not been paid

(c) has been short-levied

(d) has been short-paid

(e) has been erroneously refunded

by the reason of:-

- fraud

- collusion

- any wilful mis-statement

- suppression of facts

- contravention of any of the provisions of this Act or of the rules made thereunder with intent to evade payment of duty,

by any person chargeable with the duty, the following provisions become applicable:-

Issuance of show cause notice within FIVE years: Central Excise Officer shall, within five years from the relevant date, serve notice on such person requiring him to show cause why he should not pay the amount specified in the notice along with interest payable thereon under section 11AA and a penalty equivalent to the duty specified in the notice [Sub-section (4)].

Period of stay to be excluded: For this purpose, where the service of the notice is stayed by an order of a court or tribunal, the period of such stay shall be excluded in computing the aforesaid period of five years [Sub-section (8)].

(3) Service of a statement containing details of duty not levied/paid, short levied/paid or erroneously refunded to be deemed to be service of show cause notice: Where one show cause notice has been issued, then service of a statement containing details of non/short payment, short/non levy or erroneous refund of duty etc. would be deemed to be a service of show cause notice provided the grounds relied upon for the subsequent period are the same as are mentioned in the earlier notice(s). Therefore, the limitation period of one year or five years, as the case may be, would be computed from the date of service of such statement [Sub-section (7A)].

(4) In case the charges of fraud, collusion etc. are not established against the person to whom the notice was issued, duty to be determined for one year : Where any appellate authority or tribunal or court concludes that the notice issued under sub-section (4) is not sustainable for the reason that the charges of fraud, collusion, any wilful mis -statement, suppression of facts or contravention of any of the provisions of this Act or of the rules made thereunder with intent to evade payment of duty has not been established against the person to whom the notice was issued, the Central Excise Officer shall determine the duty of excise payable by such person for the period of one year, deeming as if the notice were issued under clause (a) of sub-section (1) [Sub-section (9)].

(5) Determination of amount of excise duty after giving an opportunity of being heard to the concerned person: The Central Excise Officer (CEO) shall, after allowing the concerned person an opportunity of being heard, and after considering the representation, if any, made by such person, determine the amount of duty of excise due from such person not being in excess of the amount specified in the notice [Sub-section (10)].

(6) Time-limit for determination of amount of excise duty: The Central Excise Officer, where it is possible to do so, determine the amount of duty under sub-section (10) as per the time schedule given below [Sub-section (11)]:

| Particulars | Time Limit (from the date of notice) |

| Cases involving willful suppression etc. [Sub-section (4)] | One year |

| Cases other than the above [Sub-section (1)] | Six months |

(7) In case of modification of duty (determined by CEO) by the appellate authority/tribunal/court, penalties and interest to be modified accordingly: Where the appellate authority or tribunal or court modifies the amount of duty of excise determined by the Central Excise Officer under sub-section (10), then the amount of penalties and interest under this section shall stand modified accordingly, taking into account the amount of duty of excise so modified [Sub-section (12)].

In case the modified amount is more than the duty determined by the CEO: Where the amount as modified by the appellate authority or tribunal or court is more than the amount determined under sub-section (10) by the Central Excise Officer, the time within which the interest or penalty is payable under this Act shall be counted from the date of the order of the appellate authority or tribunal or court in respect of such increased amount [Sub-section (13)].

(8) Payment of interest mandatory even if not specified in the order determining duty (passed under this section): Where an order determining the duty of excise is passed by the Central Excise Officer under this section, the person liable to pay the said duty of excise shall pay the amount so determined along with the interest due on such amount whether or not the amount of interest is specified separately [Sub-section (14)].

(9) Aforesaid provisions applicable to the recovery of interest also : The provisions of sub-sections (1) to (14) shall apply, mutatis mutandis, to the recovery of interest where interest payable has not been paid or part paid or erroneously refunded [Sub -section (15)].

(10) Provisions of section 11A not applicable for recovery of non/ short-payment of duty declared in the periodic returns: Provisions of section 11A will not apply to cases where the liability of duty not paid or short-paid is self-assessed and declared as duty payable by the assessee in the periodic returns filed by him. In such cases, recovery of non-payment or short-payment of duty shall be made in such manner as may be prescribed [Sub-section (16)].

Rule 8(4) of Central Excise Rules, 2002 provides that provisions of section 11 will be applicable for recovery of non/ short-payment of duty declared in the periodic returns. Section 11 provides for recovery of amount due from assessee by attachment and sale of excisable goods or certification proceedings.

IMPORTANT DEFINITIONS

For the purposes of this section and section 11AC,—

(a) “refund” includes rebate of duty of excise on excisable goods exported out of India or on excisable materials used in the manufacture of goods which are exported out of India.

(b) Meaning of relevant date

| Event | Relevant date |

| (i) Non-levy/non-payment or short levy/short payment of excise duty

(a) Where prescribed return has not been filed (b) Where return has been filed |

Last date on which such return is required to be filed Date on which such return has been filed. |

| (ii) Provisional assessment of excise duty | Date of adjustment of the excise duty after the final assessment thereof |

| (iii) Erroneous refund of excise duty | Date of such refund |

| (iv) Interest to be recovered | Date of payment of duty to which such interest relates |

| (v) Any other case | Date on which excise duty is required to be paid |

| Fraud may be defined as “deceit, imposture, criminal deception done with the intention of gaining an advantage”.

Collusion may be defined as “to act in concert especially in fraud; a secret agreement to deceive”. Willful mis-statement may be explained as “stating wrongly or falsely deliberately”. Suppression of facts may also be explained as “to hold back the facts”. Intent of evading the payment of duty may be analysed as the person acting upon to avoid the payment of duty which he was entitled to pay. Intent shows that mens-rea (knowledge) should be present. |

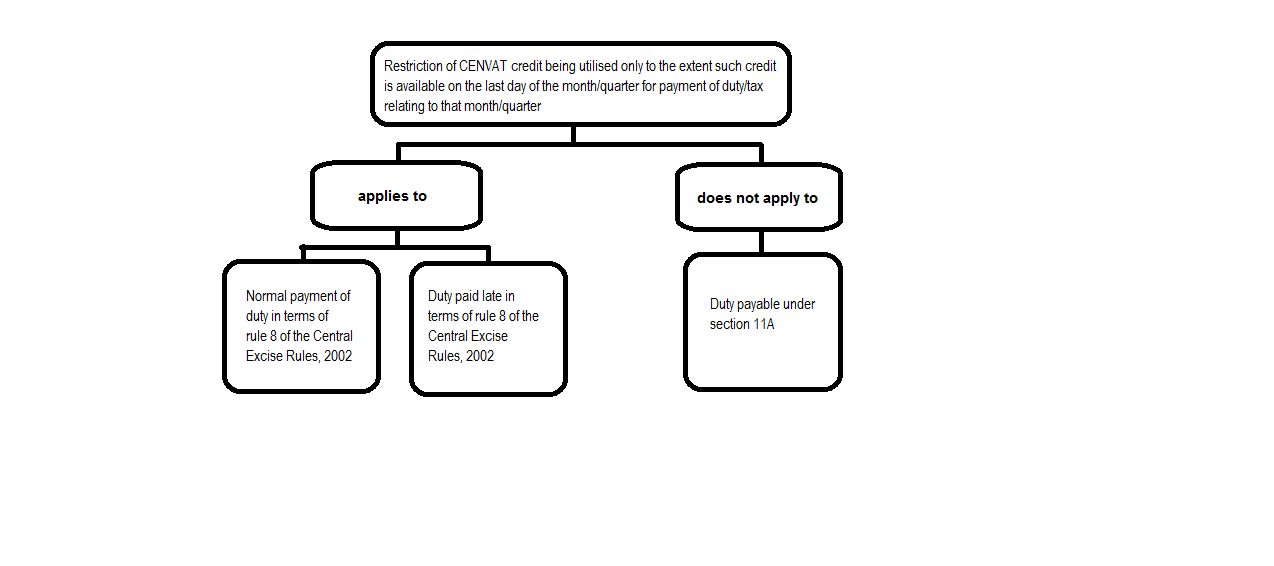

Arrears of duty under section 11A can be paid by utilizing the CENVAT credit accrued subsequent to the period to which the arrears pertained: As per rule 3(4) of the CENVAT Credit Rules, 2004, CENVAT credit to the extent available on the last day of the month/quarter can only be utilized for payment of duty or tax relating to that month or the quarter. This restriction applies only for normal payment of duty in terms of rule 8 of the Central Excise Rules, 2002, where duty for a particular month or quarter is to be discharged by the 5th of the next month or duty paid late in terms of rule 8.

However, the restriction does not apply to the demands confirmed under section 11A of the Central Excise Act, 1944 because unlike rule 8 where the duty is paid after self-determination, under section 11A, duty is determined by the Central Excise Officer and the payment is mandated after such determination. Further, there is no time limit prescribed under section 11A i.e., monthly or quarterly unlike the date prescribed under rule 8 . Therefore, the restriction on the utilisation of the CENVAT credit accuring subsequent to the last date of the month/quarter in which the arrears arise, is not applicable to the demands confirmed under section 11A of the Central Excise Act, 1944 [Circular No. 962/05/2012-CX dated 28.03.2012].