Total Income and Tax Payable :

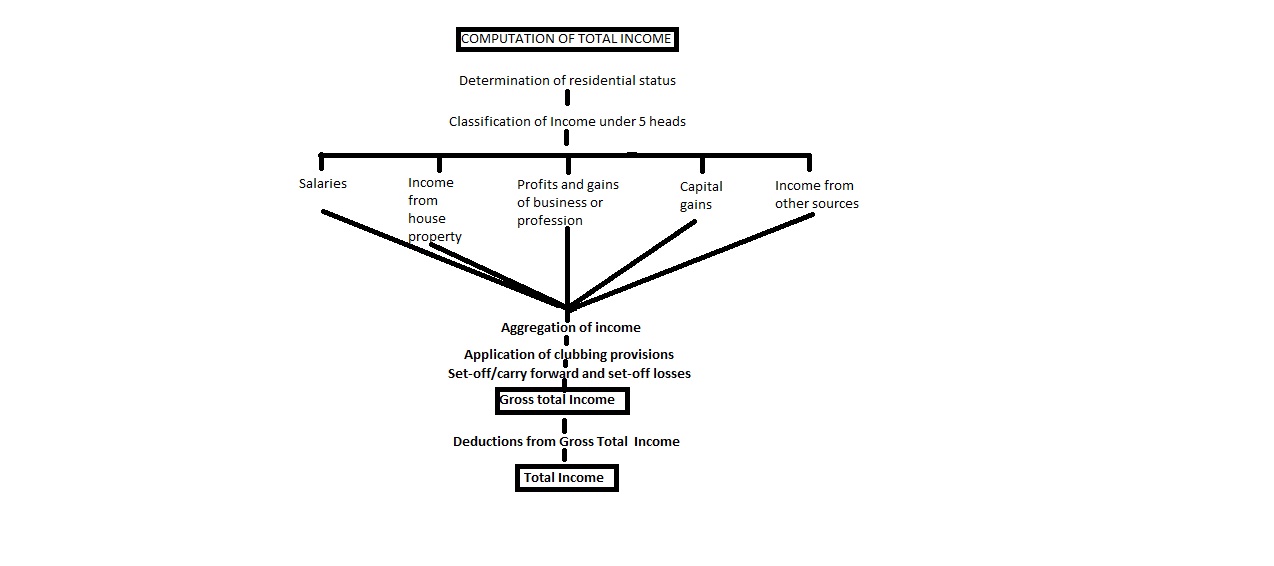

Income-tax is levied on an assessee‘s total income. Such total income has to be computed as per the provisions contained in the Income-tax Act, 1961. Let us go step by step to understand the procedure of computation of total income for the purpose of levy of income-tax.

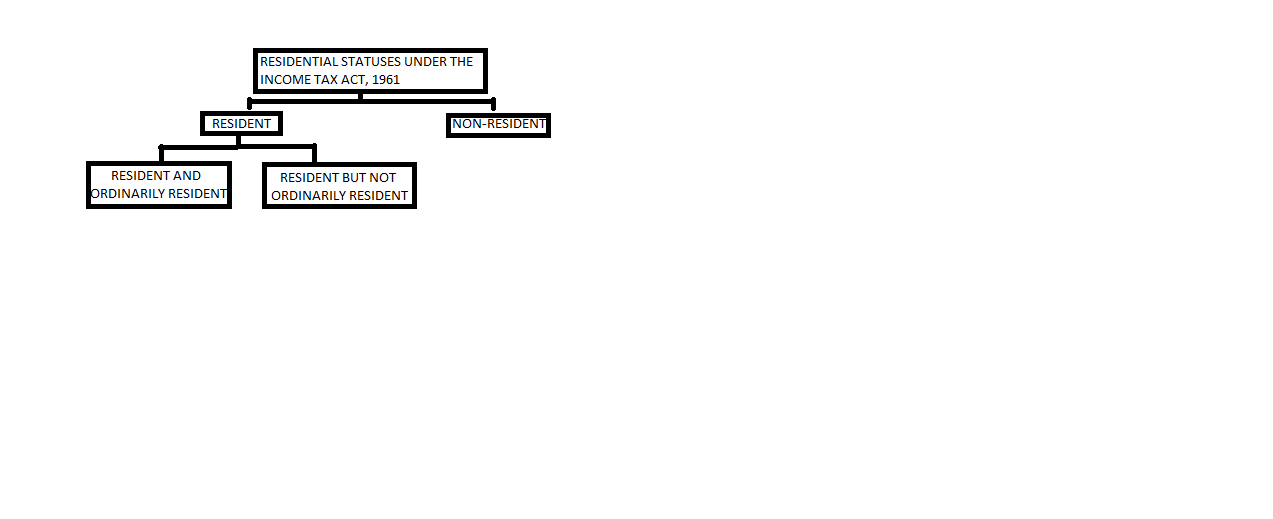

Step 1 – Determination of residential status: The residential status of a person has to be determined to ascertain which income is to be included in computing the total income. The residential statuses as per the Income-tax Act, 1961 are shown below –

In the case of an individual, the duration for which he is present in India determines his residential status. Based on the time spent by him, he may be (a) resident and ordinarily resident, (b) resident but not ordinarily resident, or (c) non-resident. The residential status of a person determines the taxability of the income. For e.g., income earned outside India will not be taxable in the hands of a non-resident but will be taxable in case of a resident and ordinarily resident.

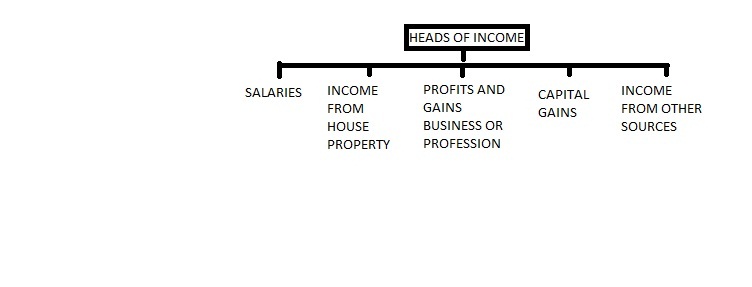

Step 2 – Classification of income under different heads: The Act prescribes five heads of income. These are shown below –

These heads of income exhaust all possible types of income that can accrue to or be received by the tax payer. Salary, pension earned is taxable under the head ―Salaries‖. Rental income is taxable under the head ―Income from house property‖. Income derived f rom carrying on any business or profession is taxable under the head ―Profits and gains from business or profession‖. Profit from sale of a capital asset (like land) is taxable under the head ―Capital Gains‖. The fifth head of income is the residuary head under which income taxable under the Act, but not falling under the first four heads, will be taxed. The tax payer has to classify the income earned under the relevant head of income.

Step 3 – Exclusion of income not chargeable to tax: There are certain income which are wholly exempt from income-tax, e.g., agricultural income. These income have to be excluded will not form part of Gross Total Income. Also, some incomes are partially exempt from income-tax e.g., House Rent Allowance, Education Allowance. These incomes are excluded only to the extent of the limits specified in the Act. The balance income over and above the prescribed exemption limits would enter computation of total income and have to be classified under the relevant head of income.

Step 4 – Computation of income under each head: Income is to be computed in accordance with the provisions governing a particular head of income. Under each head of income, there is a charging section which defines the scope of income chargeable under that head. There are deductions and allowances prescribed under each head of income. For example, while calculating income from house property, municipal taxes and interest on loan are allowed as deduction. Similarly, deductions and allowances are prescribed under other heads of income. These deductions etc. have to be considered before arriving at the net income chargeable under each head.

Step 5 – Clubbing of income of spouse, minor child etc.: In case of individuals, income-tax is levied on a slab system on the total income. The tax system is progressive i.e. , as the income increases, the applicable rate of tax increases. Some taxpayers in the higher income bracket have a tendency to divert some portion of their income to their spouse, minor child etc. to minimize their tax burden. In order to prevent such tax avoidance, clubbing provisions have been incorporated in the Act, under which income arising to certain persons (like spouse, minor child etc.) have to be included in the income of the person who has diverted his income for the purpose of computing tax liability.

Step 6 – Set-off or carry forward and set-off of losses: An assessee may have different sources of income under the same head of income. He might have profit from one source and loss from the other. For instance, an assessee may have profit from his textile business and loss from his printing business. This loss can be set-off against the profits of textile business to arrive at the net income chargeable under the head ―Profits and gains o f business or profession‖. Similarly, an assessee can have loss under one head of income, say, Income from house property and profits under another head of income, say, Profits and gains of business or profession. There are provisions in the Income-tax Act, 1961, for allowing interhead adjustment in certain cases. Further, losses which cannot be set -off in the current year due to inadequacy of eligible profits can be carried forward for set -off in the subsequent years as per the provisions contained in the Act.

Step 7 – Computation of Gross Total Income: The final figures of income or loss under each head of income, after allowing the deductions, allowances and other adjustments, are then aggregated, after giving effect to the provisions for clubbing of income and set-off and carry forward of losses, to arrive at the gross total income.

Step 8 – Deductions from Gross Total Income: There are deductions prescribed from Gross Total Income. These deductions are of three types –

Step 9 – Total income: The income arrived at, after claiming the above deductions from the Gross Total Income is known as the Total Income. It should be rounded off to the nearest multiple of Rs 10. The process of computation of total income is shown hereunder –

Step 10 – Application of the rates of tax on the total income: The rates of tax for the different classes of assesses are prescribed by the Annual Finance Act. For individuals, HUFs etc., there is a slab rate and basic exemption limit. At present, the basic exemption limit is Rs 2,50,000 for individuals. This means that no tax is payable by individuals with total income of up to Rs 2,50,000. Those individuals whose total income is more than Rs 2,50,000 but less than Rs 5,00,000 have to pay tax on their total income in excess of Rs 2,50,000 @ 10% and so on. The highest rate is 30%, which is attracted in respect of income

in excess of Rs 10,00,000. For firms and companies, a flat rate of tax is prescribed. At present, the rate is 30% on the

whole of their total income. The tax rates have to be applied on the total income to arrive at the income-tax liability.

Step 11 – Surcharge / Rebate under section 87A

Surcharge: Surcharge is an additional tax payable over and above the income-tax. Surcharge is levied as a percentage of income-tax. In case where the total income of an individual exceeds Rs 1 crore, surcharge is payable at the rate of 12% of income-tax. Rebate under section 87A: In order to provide tax relief to the individual tax payers who are in the 10% tax slab, section 87A provides a rebate from the tax payable by an assessee, being an individual resident in India, whose total income does not exceed Rs 5,00,000. The rebate shall be equal to the amount of income-tax payable on the total income for any assessment year or an amount of Rs 2,000, whichever is less.

| Level of Total Income

|

Surcharge | Rebate u/s 87A |

| ≤ Rs 5,00,000 | Not applicable | Income-tax on total income or

Rs 2,000, whichever is less |

| ≥ Rs 5,00,000 ≤ Rs 1,00,00,000

|

Not applicable | Not applicable |

| ≥ Rs 1,00,00,000

|

12% of income-tax | Not applicable |

Step 12 – Education cess and secondary and higher education cess on income-tax: The income-tax, as increased by the surcharge or as reduced by the rebate under section 87A, if applicable, is to be further increased by an additional surcharge called education cess@2%. The education cess on income-tax is for the purpose of providing universalized quality basic education. This is payable by all assessees who are liable to pay income-tax irrespective of their level of total income. Further, ―secondary and higher education cess on income -tax‖ @1% of income-tax plus surcharge, if applicable, is leviable to fulfill the commitment of the Government to provide and finance secondary and higher education.

Step 13 – Advance tax and tax deducted at source: Although the tax liability of an assessee is determined only at the end of the year, tax is required to be paid in advance in certain installments on the basis of estimated income. In certain cases, tax is required to be deducted at source from the income by the payer at the rates prescribed in the Act. Such deduction should be made either at the time of accrual or at the time of payment, as prescribed by the Act. For example, in the case of salary income, the obligation of the employer to deduct tax at source arises only at the time of payment of salary to the employees. Such tax deducted at source has to be remitted to the credit of the Central Government through any branch of the RBI, SBI or any authorized bank. If any tax is still due on the basis of return of income, after adjusting advance tax and tax deducted at source, the assessee has to pay such tax (called self-assessment tax) at the time of filing of the return.