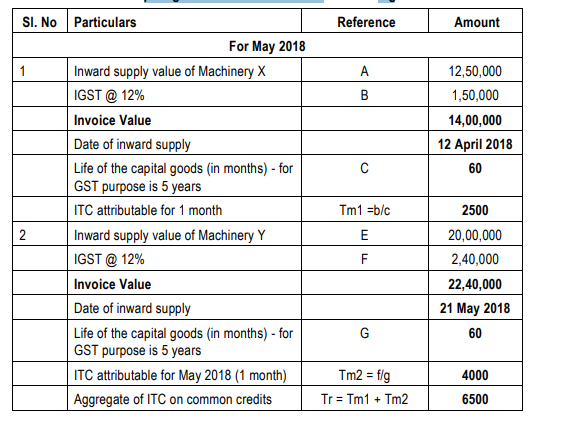

Annexure A – ITC on capital goods whose residual life is remaining :

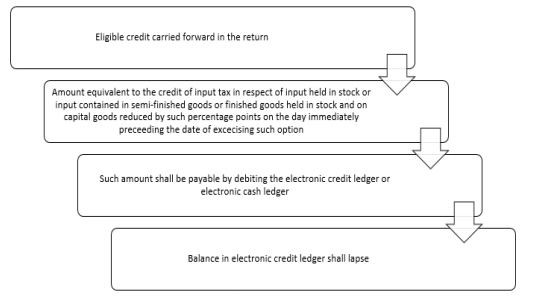

Rule 44 mandates credit reversal when a registered person switches from regular scheme to composition scheme or goods and services supplied by him become wholly exempt:

Pay an amount by debiting electronic cash ledger / credit ledger, equivalent to input tax credit of –

— Inputs held in stock

— Inputs contained in semi-finished or finished goods held in stock and

— Capital goods

On the day immediately preceding the date of such switch over.

Balance of input tax credit lying in the electronic credit ledger, after payment of the above said amount, shall lapse.

Such amount is calculated in manner to be prescribed

Pay and Exit Scheme: