Assessees engaged in the business of transmission of power eligible for additional depreciation [Section 32(1)(iia)]

Effective from: A.Y. 2017-18

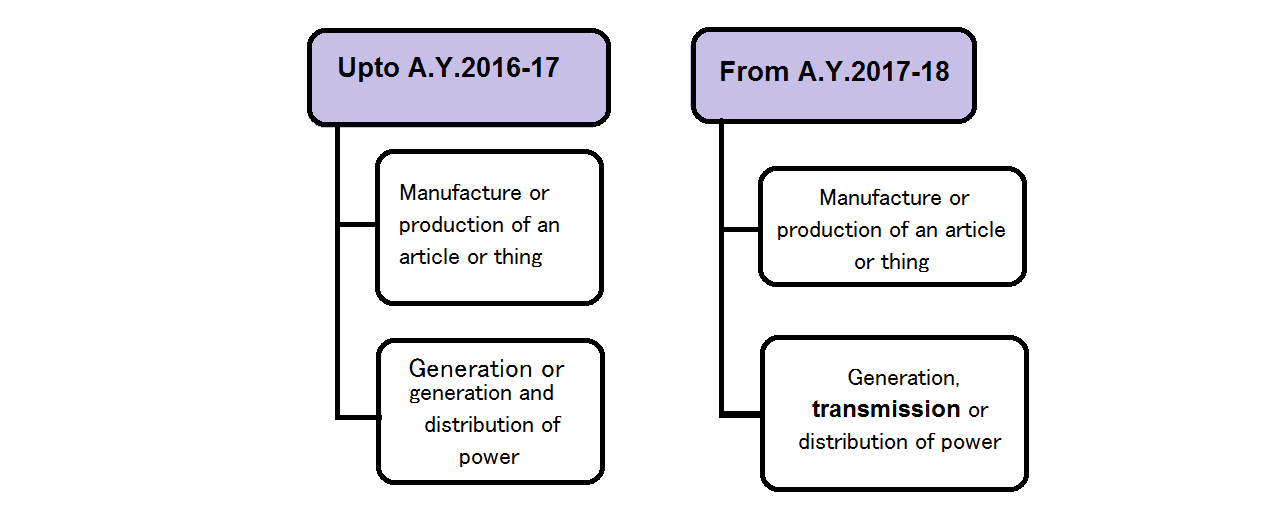

(i) Section 32(1)(iia) allows additional depreciation@20% in respect of the cost of new plant or machinery acquired and installed by certain assessees engaged in, inter alia, the business of generation and distribution of power .

(ii) This additional depreciation available under section 32(1)(iia) is over and above the deduction allowed for normal depreciation under section 32(1)(ii) at the rates specified in new Appendix 1A read with Rule 5.

(iii) This incentive was so far not available in respect of new machinery or plant installed by an assessee engaged in the business of transmission of power.

(iv) The benefit of additional depreciation@20% of actual cost of new machinery or plant acquired and installed in a previous year under section 32(1)(iia) has now been extended to an assessee engaged in the business of transmission of power also.

Businesses eligible for claim of additional depreciation under section 32(1)(iia)