Company to have Board of Directors (Section 149 of the Companies Act, 2013) :

This section provides for the provisions for companies to have a duly constituted Board of Directors. According to this section:

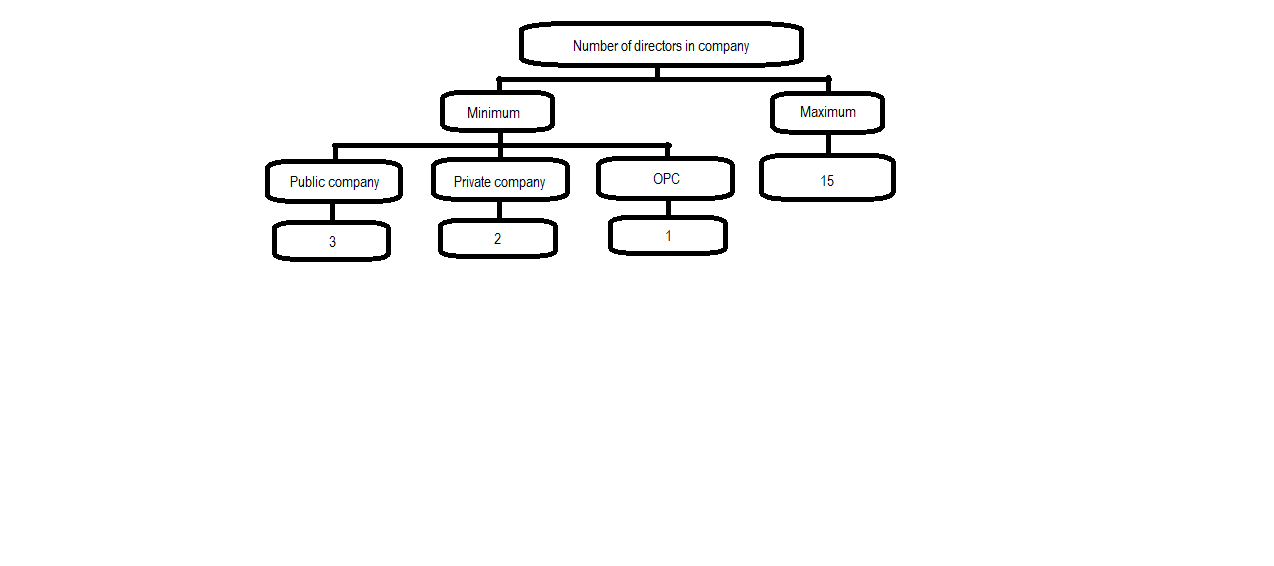

(i) Number of Directors: According to section 149(1) of the Companies Act, 2013, every company shall have a Board of Directors consisting of individuals as directors and shall have-

(a) minimum number of directors:

(A) in the case of Public company-3,

(B) in the case of Private Company-2, and

(C) in case of One person company (OPC)-1

(b) maximum number of directors: 15

If the company wants to appoint more than 15 directors, it can do so after passing a special resolution.

As per the Notification G.S.R. 463(E) dated 5th June, 2015, the limit of maximum of 15 directors and their increase in limit by special resolution shall not apply to Government company.

Further, as per the Notification G.S.R. 466(E) dated 5th June, 2015, the minimum and maximum limit of number of directors and their increase in limit by special resolution shall not apply to Section 8 companies.

(c) Women director: At least one woman director shall be on the Board of such class or classes of companies as may be prescribed. [Second proviso to section 149(1)]

Rule 3 of the Companies (Appointment and Qualification of Directors) Rules, 2014 provides that the following class of companies shall appoint at least one woman director –

(1) every listed company;

(2) every other public company having –

(A) paid–up share capital of one hundred crore rupees or more;

or

(B) turnover of three hundred crore rupees or more:

A company, which has been incorporated under the Act and is covered under provisions of second proviso to sub-section (1) of section 149 shall comply with such provisions within a period of six months from the date of its incorporation.

Further, any intermittent vacancy of a woman director shall be filled-up by the Board at the earliest but not later than immediate next Board meeting or three months from the date of such vacancy whichever is later.

For e.g., in XYZ Ltd., an intermittent vacancy of the women director arises on 15th June, 2015. Thus, the vacancy shall be filled-up by the Board at the earliest but not later than the date of the next Board meeting or three months from the date of such vacancy whichever is later.

- If after the vacancy, the immediate Board meeting was held on 14th August, 2015, then the vacancy shall be filled-up by 14th August, 2015 or by 14th Sept. 15(3 months from the date of such vacancy) whichever is later. In this case it shall be filled up by 14th Sept. 15.

- If after the vacancy, the immediate Board meeting was held on 14th October, 2015 then the vacancy shall be filled-up by 14th October, 2015 or by 14th Sept. 15 whichever is later. In this case it shall be filled up by 14th October 15.

Explanation.- For the purposes of this rule (woman director on board), it is clarified that the paid up share capital or turnover, as the case may be, as on the last date of latest audited financial statements shall be taken into account.

(d) Resident Director: Every company shall have at least one director who has stayed in India for a total period of not less than 182 days in the previous calendar year. [Section 149(3)]

Transition period: Section 149(5) provides for the transition period of one year from the date of commencement i.e. 1st April, 2014 to comply with section 149(3).

The MCA vide General Circular No. 25/2014 dated 26th June, 2014 has given a clarification on applicability of requirement for resident director in the current calendar/ financial year. Section 149(3) of the Companies Act, 2013 requires every company to have at least one director who has stayed in India for a total period of not less than 182 days in the previous calendar year. The MCA clarified that ‘residency requirement‘ would be reckoned from the date of commencement of section 149 of the Act i.e. 1st April, 2014. The first ‘previous calendar year‘ for compliance with these provisions would, therefore, be calendar year 2014. The period to be taken into account for compliance with these provisions will be the remaining period of calendar year 2014 (i.e. 1st April to 31st December). Therefore, on a proportionate basis, the number of days for which the director(s) would need to be resident in India, during Calendar year 2014, shall exceed 136 days.

Regarding newly incorporated companies it is clarified that companies incorporated between 1st April, 2014 to 30th September, 2014 should have a resident director either at the incorporation stage itself or within six months of their incorporation. Companies incorporated after 30th September, 2014 need to have the resident director from the date of incorporation itself.

(e) Independent Director: Every listed public company shall have at least one-third of the total number of directors as independent directors. [Section 149(4)]

The Central Government may prescribe the minimum number of independent directors in case of any class or classes of public companies.

Any fraction contained in such one-third numbers shall be rounded off as one.

According to the Rule 4 of the Companies (Appointment and Qualification of Directors) Rules, 2014, the following class or classes of companies shall have at least 2 directors as independent directors:

(1) the Public Companies having paid up share capital of 10crore rupees or more; or

(2) the Public Companies having turnover of 100 crore rupees or more; or

(3) the Public Companies which have, in aggregate, outstanding loans, debentures and deposits, exceeding 50 crore rupees.

However, in case a company covered as under the above rule is required to appoint a higher number of independent directors due to composition of its audit committee, such higher number of independent directors shall be applicable to it.

For e.g.: As per section 177(2) of the Companies Act, 2013, the Audit Committee shall consist of a minimum of three directors with independent directors forming a majority. So, if for example, XYZ Ltd. is having 6 directors in its Audit Committee, then 4 directors out of 6 must be Independent Directors (4 is forming majority). Therefore, although in terms of the the Companies (Appointment & Qualification) Rules 2014 the company is required to have at least 2 Independent directors, in this case the limit of 2 will increase to 4 as the company is required to appoint a higher number of independent directors due to composition of its audit committee.

Further, any intermittent vacancy of an independent director shall be filled-up by the Board at the earliest but not later than immediate next Board meeting or three months from the date of such vacancy, whichever is later.

For e.g., in XYZ Ltd., the vacancy of the independent director arises on 15th June, 2015. Thus, the vacancy shall be filled-up by the Board at the earliest but not later than immediate next Board meeting or three months from the date of such vacancy whichever is later.

- If the immediate next Board meeting after the vacancy was held on 14th August, 2015, then the vacancy shall be filled-up by 14th August, 2015 or by 14th Sept. 2015 whichever is later. In this case it shall be filled up by 14th Sept. 2015.

- If the immediate next Board meeting after the vacancy was held on 14th October, 2015, then the vacancy shall be filled-up by 14th October, 2015 or by 14th Sept. 2015 whichever is later. In this case it shall be filled up by 14th October 2015.

However, where a company ceases to fulfill any of three conditions laid down above for three consecutive years, it shall not be required to comply with these provisions until such time as it meets any of such conditions.

For the purpose of the above assessment, the paid up share capital or turnover or outstanding loans, debentures and deposits, as the case may be, as existing on the last date of latest audited financial statements shall be taken into account.

A company belonging to any class of companies for which a higher number of independent directors has been specified in the law for the time being in force shall comply with the requirements specified in such law.

(f) Who can become the Independent Director [Section 149(6)]: In relation to a company, an independent director means a director other than a managing director or a whole -time director or a nominee director, and who fulfills the following criteria:

(1) who, in the opinion of the Board, is a person of integrity and possesses relevant expertise and experience;

(2) (A) who is or was not a promoter of the company or its holding, subsidiary or associate company;

(B) who is not related to promoters or directors in the company, its holding, subsidiary or associate company;

(3) who has or had no pecuniary relationship with the company, its holding, subsidiary or associate company, or their promoters, or directors, during the two immediately preceding financial years or during the current financial year;

As per Notification 463 (E) dated 5th June, 2015, the above point no. (3) [section 149(6)(c)] shall not apply in case of a Government company.

(4) none of whose relatives has or had pecuniary relationship or transaction with the company, its holding, subsidiary or associate company, or their promoters, or directors, amounting to 2% or more of its gross turnover or total income or 50 lakh rupees or such higher amount as may be prescribed, whichever is lower, during the two immediately preceding financial years or during the current financial year;

(5) who, neither himself nor any of his relatives—

(A) holds or has held the position of a key managerial personnel or is or has been employee of the company or its holding, subsidiary or associate company in any of the 3financial years immediately preceding the financial year in which he is proposed to be appointed;

(B) is or has been an employee or proprietor or a partner, in any of the three financial years immediately preceding the financial year in which he is proposed to be appointed, of—

(i) a firm of auditors or company secretaries in practice or cost auditors ofthe company or its holding, subsidiary or associate company; or

(ii) any legal or a consulting firm that has or had any transaction with the company, its holding, subsidiary or associate company amounting to ten per cent. or more of the gross turnover of such firm;

(C) holds together with his relatives 2% or more of the total voting power of the company; or

(D) is a Chief Executive or director, by whatever name called, of any non- profit organisation that receives twenty-five per cent or more of its receipts from the company, any of its promoters, directors or its holding, subsidiary or associate company or that holds 2% or more of the total voting power of the company; or

(6) who possesses such other qualifications as may be prescribed. According to the Companies (Appointment and Qualification of Directors) Rules, 2014, independent director shall possess appropriate skills, experience and knowledge in one or more fields of finance, law, management, sales, marketing, administration, research, corporate governance, technical operations or other disciplines related to the company‘s business.

(g) Declaration by Independent Director [Section 149(7)]: Every independent director shall

(1) at the first meeting of the Board in which he participates as a director; and

(2) thereafter at the first meeting of the Board in every financial year; or

(3) whenever there is any change in the circumstances which may affect his status as an independent director, give a declaration that he meets the criteria of independence as provided in sub-section (6).

(h) Code for independent directors [Section 149(8)]: The company and independent directors shall abide by the provisions specified in Schedule IV to the Companies Act, 2013.

(i) Remuneration of Independent Directors [Section 149(9)]: Notwithstanding anything contained in any other provision of this Act, but subject to the provisions of sections 197 and 198, an independent director shall not be entitled to any stock option and may receive remuneration by way of

(1) fee provided under section 197(5),

(2) reimbursement of expenses for participation in the Board and other meetings and

(3) profit related commission as may be approved by the members.

| Entiled to: | Not Entitled to: |

| Fee provided under section 197(5) | Any stock option |

| Reimbursement of expenses for participation in:

(i) Board Meetings (ii) Other Meetings |

|

| Profit related commission as may be approved by the members |

(j) Tenure [Section 149(10) & (11)]:

(i) Subject to the provisions of section 152 (Appointment of directors), an independent director shall hold office for a term up to five consecutive years on the Board of a company. He shall be eligible for re-appointment on passing of a special resolution by the company and disclosure of such appointment in the Board’s report.

(ii) No independent director shall hold office for more than two consecutive terms. However, such independent director shall be eligible for appointment after the expiration of three years of ceasing to be an independent director:

Provided that during the said period of three years, such independent director shall not,be appointed in or be associated with the company in any other capacity, either directly or indirectly.

(iii) For the purposes of sub-sections (10) and (11), any tenure of an independent director on the date of commencement of this Act shall not be counted as a term under those sub-sections.

(k) Liability [Section 149(12)]: As per section 149(12) of the Companies Act, 2013, Notwithstanding anything contained in this Act,—

(i) an independent director;

(ii) a non-executive director not being promoter or key managerial personnel, shall be held liable, only in respect of such acts of omission or commission by a company which had occurred with his knowledge, attributable through Board processes, and with his consent or connivance or where he had not acted diligently.

| Parties Liable | Liable Acts |

| (i) an independent director | · acts of omission or commission by a company which had occurred with his knowledge,

· attributable through Board processes · with his consent or connivance, or where he had not acted diligently |

| (ii) a non-executive director not being promoter or key managerial personnel |

(l) Retirement by rotation [Section 149(13)]: The provisions of retirement of directors by rotation covered under sub-sections (6) and (7) of section 152 shall not be applicable to appointment of independent directors.

(Note: The provisions of retirement of directors by rotation covered under sub-sections (6) and (7) of section 152 will be discussed later on in this chapter)

Here,in section 149 “Nominee director” means a director nominated by any financial institution in pursuance of the provisions of any law for the time being in force, or of any agreement, or appointed by any Government, or any other person to represent its interests.

The MCA vide General Circular No. 14/2014 dated 9th June, 2014 has given some clarifications over manner relating to appointment and qualifications of directors and Independent Directors which are as under:

(i) Section 149(6)(c) : “pecuniary interest in certain transactions”:

(a) This provision inter alia requires that an ‘ID’ should have no ‘pecuniary relationship’ with the company concerned or its holding/ subsidiary / associate company and certain other categories specified therein during the current and last two preceding financial years. Clarifications have been sought whether a transaction entered into by an ‘ID’ with the company concerned at par with any member of the general public and at the same price as is payable/paid by such member of public would attract the bar of ‘pecuniary relationship’ under section 149(6)(c). The matter has been examined and it is hereby clarified that in view of the provisions of section 188 which take away transactions in the ordinary course of business at arm’s length price from the purview of related party transactions, an ‘ID’ will not be said to have ‘pecuniary relationship’ under section 149(6)(c) in such cases.

(b) Stakeholders have also sought clarification whether receipt of remuneration, (in accordance with the provisions of the Act) by an ‘ID’ from a company would be considered as having pecuniary interest while considering his appointment in the holding company, subsidiary company or associate company of such company. The matter has been examined in consultation with SEBI and it is clarified that ‘pecuniary relationship’ provided in section 149(6)(c) of the Act does not include receipt of remuneration, from one or more companies, by way of fee provided under sub-section (5) of section 197, reimbursement of expenses for participation in the Board and other meetings and profit related commission approved by the members, in accordance with the provisions of the Act.

(ii) Section 149: Appointment of ‘IDs’: Clarification has been sought if ‘IDs’ appointed prior to April 1, 2014 may continue and complete their remaining tenure, under the provisions of the Companies Act, 1956 or they should demit office and be re-appointed (should the company so decide) in accordance with the provisions of the new Act. The matter has been examined in the light of the relevant provisions of the Act, particularly section 149(5) and 149(10) & (11) .Explanation to section 149(11) clearly provides that any tenure of an ‘ID’ on the date of commencement of the Act shall not be counted for his appointment/holding office of director under the Act. In view of the transitional period of one year provided under section 149(5), it is hereby clarified that it would be necessary that if it is intended to appoint existing ‘IDs’ under the new Act, such appointment shall be made expressly under section 149(10)/(11) read with Schedule IV of the Act within one year from 1st April, 2014, subject to compliance with eligibility and other prescribed conditions.

(iii) Section 149(10) / (11)- Appointment of ‘IDs’ for less than 5 years:Clarification has been sought as to whether it would be possible to appoint an individual as an ID for a period less than five years. It is clarified that section 149(10) of the Act provides for a term of “upto five consecutive years” for an ‘ID’. As such while appointment of an ‘ID’ for a term of less than five years would be permissible, appointment for any term (whether for five years or less) is to be treated as a one term under section 149(10) of the Act. Further, under section 149(11) of the Act, no person can hold office of ‘ID’ for more than ‘two consecutive terms’. Such a person shall have to demit office after two consecutive terms even if the total number of years of his appointment in such two consecutive terms is less than 10 years. In such a case the person completing ‘consecutive terms of less than ten years’ shall be eligible for appointment only after the expiry of the requisite cooling-off period of three years.

(iv) Appointment of ‘IDs’ through letter of appointment:- With reference to Para IV(4) of Schedule IV of the Act (Code for IDs) which requires appointment of ‘IDs’ to be formalized through a letter of appointment, clarification has been sought if such requirement would also be applicable for appointment of existing ‘IDs’? The matter has been examined. In view of the specific provisions of Schedule IV, appointment of ‘IDs’ under the new Act would need to be formalized through a letter of appointment.

Note: The MCA vide Notification No.466(E) dated 5th June, 2015, has exempted section 8 companies from following the provisions of sub-section (4), (5), (6), (7), (8), (9), (10), (11), clause (i) of sub- section (12) [related to independent director] and sub- section (13) of section 149 of the Companies Act, 2013.