Concept of Permanent Establishment :

In order to determine the taxability of business income of foreign enterprises operating in India, it is important to determine the existence of a Permanent Establishment (‘PE‘). Article 5(1) of the DTAA provides that for the purpose of this convention the term ‘Permanent Establishment‘ means a fixed place of business through which the business of an enterprise is wholly or partly carried on. The term ‘Enterprise‘ has been defined in section 92F(iii) [See discussion under section 92A in Chapter 16].

According to Article 5(2), which enumerates various instances of PE, the term PE includes (a) a place of management; (b) a branch; (c) an office; (d) a factory; (e) a workshop; (f) a sales outlet; (g) a warehouse; (h) a mine, an oil or gas well, a quarry or other place of extraction of natural resources (but not exploration).

(1) Permanent establishment means a fixed place of business through which the business of an enterprises is wholly or partly carried on.

(2) Every DTAA has a specific clause, which will deal with an explanation of permanent establishment for the purpose of such DTAA.

(3) Business Income of a non resident will not be taxed in India, unless such non-resident has a permanent establishment in India.

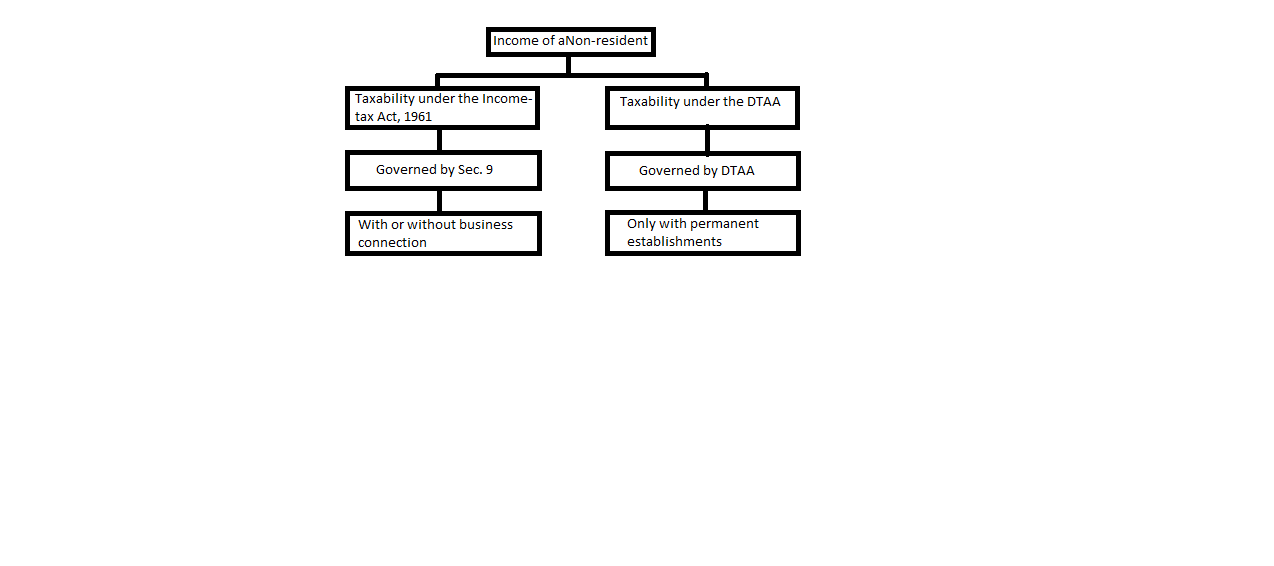

(4) Taxability of income under business connection and permanent establishment is explained here below :