CONTINGENT ASSETS AND CONTINGENT LIABILITIES :

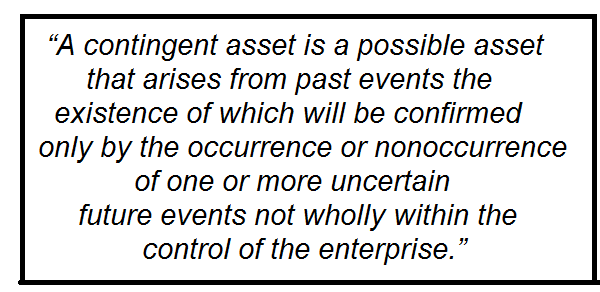

(i) CONTINGENT ASSETS:

The assets in which the possibility of an economic benefit depends solely upon future events that can’t be controlled by the company are contingent assets. Due to the uncertainty of the future events, these assets are not placed on the balance sheet. However, they are presented in the company’s financial statement notes. These assets are often simply rights to a future potential claim based on past events.

Contingent assets usually arise from unplanned or other unexpected events that give rise to the possibility of an inflow of economic benefits to the enterprise.

Contingent assets are not recognized in financial statements since this may result in the recognition of income that may never be realised. It is usually disclosed in the report of the approving authority where an inflow of economic benefits is probable. However, when the realisation of income is virtually certain, then the related asset is not a contingent asset and its recognition is appropriate.

Example: A potential settlement from a lawsuit or legal processes. The company does not have enough certainty to place the settlement value on the balance sheet, so it can only mention about the potential in the notes. This improves the accuracy of financial statements.

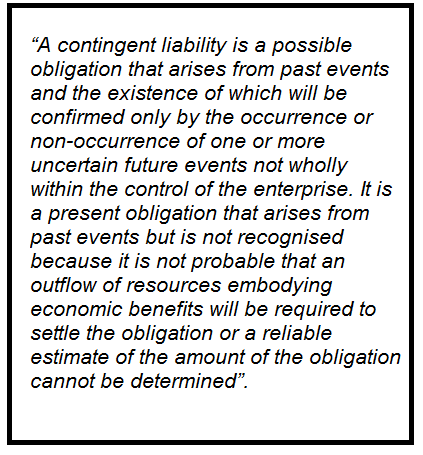

(ii) CONTINGENT LIABILITIES

The possibility of an obligation to pay certain sums dependent on future events is known as contingent liability. Contingent liabilities are liabilities that may or may not be incurred by an entity depending on the outcome of a future event.

They are defined obligations by a company that must be met, but the probability of such payment is minimal. The nature and extent of the contingent liabilities is described in the footnote to the balance sheet.

These liabilities are recorded in a company’s accounts and shown in the balance sheet only when both probable and reasonably estimable.

Some good examples of contingent liabilities would be an outstanding lawsuit, bank guarantee etc. Suppose, if a company issued by a former employee for Rs.500,000 for discrimination, the company will have a liability if it is found guilty. However, if the company is not found guilty, the company will not have an actual liability. Such a liability is known as a contingent liability.