Any person, who contravenes any of the provisions of this Act or any rules made thereunder for which no penalty is separately provided for in this Act, shall be liable to a penalty which may extend to twenty-five thousand rupees.

Introduction

The duty of the State is not only to recover all lawful dues from a defaulter, but to do justice towards the law abiding populace to impose a penalty – jus in rem. To this end offences are listed in section 122 along with penalty specifically applicable to each. Any offence that does not have a specific penalty prescribed cannot be let off without penal consequences. Section 125 is a general penalty provision under the GST law for cases where no separate penalty is prescribed under the Act or rules.

Analysis

Penalty upto ` 25,000/- is imposable where any person contravenes: (a) any of the provisions of the Act; or (b) rules made thereunder. for which no penalty is separately prescribed under the Act.

Comparative review

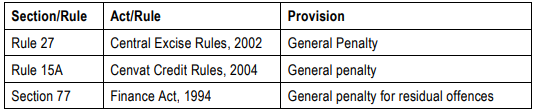

General penalty provisions are more or less in line with the following provisions of subsumed Central laws in addition to the provisions of VAT laws of various States:

The residuary penalty as prescribed under service tax law and central excise law is upto ` 10,000/- and ` 5,000/ respectively-. There is substantial increase in maximum limit of penalty as prescribed under the GST Act.