Introduction of Procedure for distribution of input tax credit by Input Service Distributor :

This Section sets forth the way input tax credit (of services) is distributed to supplier of goods or services or both of same entity having same PAN. Procedure for distribution is given in Rule 39 of Central Goods and Service Tax Rules, 2017.

Analysis

(i) An ISD shall distribute the eligible ITC in accordance with Rule 39 elucidated in the following paras.

(ii) Input Service Distributor (ISD) is an office of the supplier of goods or services or both where a document (like invoice) of services attributable to other locations are received (since they might be registered separately). Since the services relate to other locations the corresponding credit should be transferred to such locations (having separate registrations) as services are supplied from there. Care should be taken to ensure that an inter-branch supply of services should not be misinterpreted as a distribution by ISD. Please recollect that ISD cannot be an office that does any supply of its own but must be one that merely collects invoice for services and issues prescribed document for its distribution.

(iii) ISD cannot normally be used in a situation where there is a liability to pay GST. It can only receive input tax credits on invoices related to input services and distribute such credits in the manner discussed below. An ISD cannot discharge tax liability under reverse charge. This would require obtaining another registration as a regular registered person and discharge RCM liability.

Examples hereunder are as per rules.

Illustration: Corporate office of XYZ company Ltd., is at New Delhi, having its business locations of selling and servicing of goods at New Delhi, Chennai, Mumbai and Kolkata. For example, if the software license and maintenance is used at all the locations, invoice indicating CGST and SGST is received at Corporate Office. Since the software is used at all the four locations, the input tax credit of entire services cannot be claimed at New Delhi. The same has to be distributed to all four locations. For that reason, the Delhi Corporate office h as to act as ISD to distribute the credit.

Rule 39: Central Goods and Service Tax Rules, 2017

The example provided below illustrates the application of Rule 39 of the Central Goods and Service Tax Rules, 2017 for distribution of credits by an Input Service Distributor (ISD) in terms of Section 20.

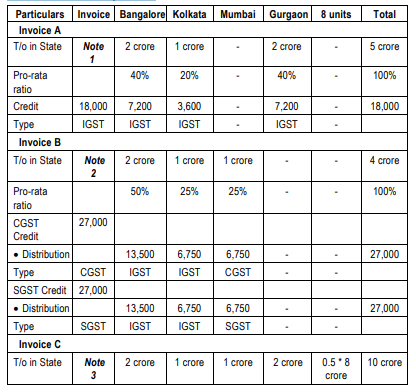

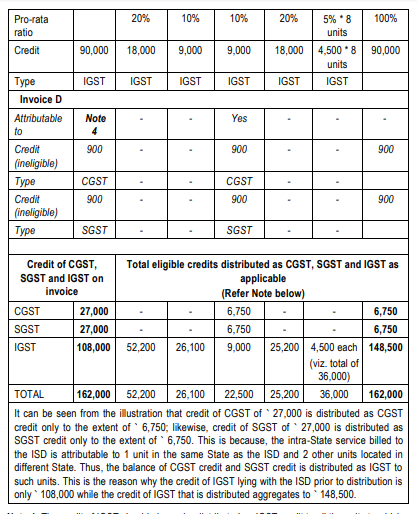

Yoko Infotech Ltd. has its head office in Mumbai, for which it additionally has an ISD registration. The company has 12 units across India including its head office. It receives the following invoices in the name of the ISD at Mumbai, for the month of January 2018:

Invoice A: ` 100,000 @ IGST 18,000 issued by Peace Link Technologies (registered in Uttar Pradesh) for repairs executed in 3 units – Bangalore, Kolkata, Gurgaon (Note: Gurgaon location is not registered as it is engaged in making only exempt supplies);

Invoice B: ` 300,000 @ CGST 27,000, SGST 27,000 issued by M/s. Tec Force (registered in Pune) for repairs executed in 3 units – Mumbai, Bangalore, Kolkata;

Invoice C: ` 500,000 @ IGST 90,000 issued by M/s. Georgia Marketing (registered in Bangalore) for marketing services for the company;

Invoice D: ` 10,000 @ CGST 900 & SGST `900 issued by M/s. Gopal Coffee works (registered in Mumbai) for supply of beverages during the month to its Mumbai unit. All taxes have been considered at 18% (CGST and SGST at 9% each).

The turnover of each of the units during the year 2016-17 is: Mumbai: 1 crore; Bangalore 2 crore; Kolkata 1 crore; Gurgaon 2 crore; each of the other 8 units: 50 lakhs, resulting in the aggregate turnover of the company in the previous financial year, of 10 crores.

Distribution of credits by the ISD:

Note 1: The credit of IGST should always be distributed as IGST credit to all the units to which the service is attributable, regardless of where they are located.

The credits should be distributed only to those units to which the service is attributable. Given that the service mentioned in the case of Invoice A is attributable only to Bangalore, Kolkata and Gurgaon, the entire input tax credit applicable to the case

should be distributed to the said 3 units, on a pro rata basis in the ratio of their respective ‘Turnover in State’ to the aggregate of the 3 ‘Turnover in State’ (i.e., 2 Cr + 1Cr + 2 Cr). Further, no differentiation is made to whether the unit is registered or not, and therefore, credit attributable to the Gurgaon unit is distributed to that unit although it is not registered, which implies, it is a loss of credit.

The ‘turnover in State’ is arrived at a value for the ‘relevant period’. Since all 12 units were operational during the preceding financial year, the relevant period would be the preceding financial year.

Note 2: The credit of CGST and SGST should be distributed as IGST credit to all the units located outside the State in which the ISD is located, and as CGST and SGST respectively, in case of distribution of credit to a unit located in the same State as the ISD. Thus, the CGST and SGST credits are distributed as IGST credits to Bangalore and Kolkata, and as CGST & SGST respectively, to Mumbai.

Given that the service supplied in terms of Invoice B is attributable only to Bangalore, Kolkata and Mumbai, the entire input tax credit applicable to the case should be distributed to the said 3 units, on a pro rata basis in the ratio of their respective ‘Turnover in State’ to the aggregate of the 3 ‘Turnover in State’ (i.e., 2 Cr + 1Cr + 1 Cr).

Note 3: The credit of IGST is distributed as IGST to all the units to which the service is attributable.

Invoice C relates to a supply of service that is attributable to all the units , and hence, the credits would be distributed on a pro-rata basis of the ‘Turnover in State’ of each of the units, to the aggregate of ‘Turnover in State’ of all the 12 units, i.e., `10 Cr.;

For convenience of presentation, only one column is shown to reflect the distribution to each of the 8 units, having the same ‘turnover in State’, and to which the same invoice is attributable.

Note 4: Given that the services for receipt of food and beverages would not be eligible input services, the taxes relating to Invoice D should be distributed as ineligible input tax (900 + 900), and the distribution must be done separately.

Since the service is wholly attributable to the Mumbai unit, the distribution is done only to such unit

(iv) Distribution of credit where ISD and recipient are located in different States under CGST Act: As per Rule 39(1)(e) and (f) of Central Goods and Service Tax Rules, 2017 ISD shall distribute as prescribed, credit of CGST as CGST or IGST and credit of IGST

as IGST by issuing prescribed document mentioning the amount of credit distributed to recipient of credit located in different States.

Illustration: In the above illustration, if the corporate office of XYZ Ltd being an ISD situated in Delhi receives invoices indicating `4 lakhs of CGST in one service and ` 7

lakhs as of IGST in another case. It shall distribute CGST of ` 4 Lakhs IGST and credit of IGST of ` 7 Lakhs also as IGST to its locations at Chennai, Mumbai and Kolkata under a prescribed document containing the amount of credit distributed.

(v) Distribution of credit where ISD and recipient are located in different States under SGST Act: ISD could distribute as prescribed credit of SGST as IGST only (and not as SGST of other State) by issuing a prescribed document containing the amount of credit distributed.

Illustration: In the above illustration, corporate office of XYZ Ltd., also received SGST of ` 6 Lakhs along with ` 4 Lakhs of CGST. It can distribute SGST credit as IGST to its locations at Chennai, Mumbai and Kolkata under a prescribed document containing the amount of credit distributed.

(vi) Distribution of credit where ISD and recipient are located within the State under CGST Act: In cases where an entity has different registration within the same State by an entity, it may have to distribute credit to such location also similar to locations with different registrations outside the State. In order to enable the same, it is provided that ISD can distribute in the prescribed manner, credit of CGST as CGST and credit of IGST as IGST by issuing prescribed document mentioning the amount of credit distributed to recipient being a business vertical.

Illustration: ABC Ltd., having its office at Bangalore is having another business vertical in Mysore which is separately registered. In such a case, out of input tax credit of ` 4 lakhs of CGST, the credit attributable to ABC Ltd, Bangalore, shall be distributed to Mysore location as CGST. Similarly out of input tax credit of ` 10 Lakh of IGST, the credit attributable to ABC Ltd, Bangalore shall be distributed to Mysore location as IGST.

(vii) Distribution of credit where ISD and recipient are located within the State under SGST Act: Similar to the provisions of CGST as indicated supra under CGST Act, even under the SGST Act, it is provided that an ISD can distribute in the prescribed manner, credit of SGST and IGST as SGST (of the same State and not other State) and IGST respectively, by issuing a prescribed document mentioning the amount of credit distributed to recipient being a business vertical.

Illustration: In the same example of ABC Ltd., above the input tax credit say ` 6 lakhs of SGST shall be distributed as SGST.

(viii) Conditions to distribute credit by ISD: The conditions to distribute the credit by ISD are as follows:

(a) Credit to be distributed to recipient under prescribed documents containing prescribed details. Such document should be issued to each of the recipient of credit.

(b) Credit distributed should not exceed the credit available for distribution.

(c) Tax paid on input services used by a particular location (registered as supplier), is to be distributed only to that location.

(d) Credit of tax paid on input service used by more than one location who are operational is to be distributed to all of them based on the pro rata basis of turnover of each location in a State to aggregate turnover of all such locations who have used such services.

Note: The period to be considered for computation is the previous financial year of that location. If it does not have any turnover in the previous financial year, then previous quarter of the month to which the credit is being distributed.

(ix) For a detailed discussion on Tax invoice or Credit note to be issued by an ISD reference maybe made to Chapter VII. The said Chapter VII clearly indicates the particulars to be included in such a document.

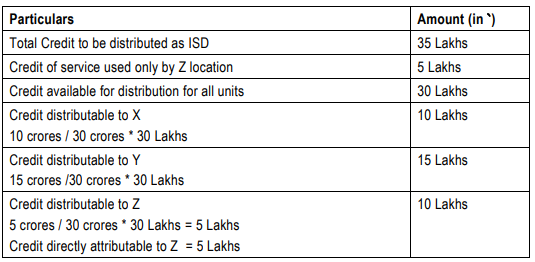

Illustration 1: A Ltd as an ISD has input service credit of ` 35 lakhs used by more than one locations, to be distributed among recipients locations X, Y and Z. The turnover of X, Y, Z in preceding financial year, is ` 10 crores, ` 15 crores and ` 5 crores respectively. The credit of ` 5 lakhs pertains to input service received only by Z. The credit attributable to X, Y, Z are as follows:

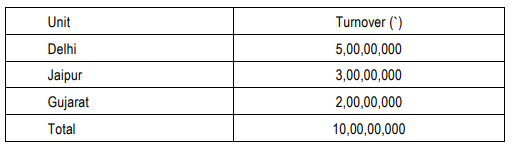

Illustration 2: Distribution of input tax credit by an ISD to its units is shown as under:

M/s XYZ Ltd, having its head Office at Delhi, is registered as ISD. It has three units in different State namely ‘Delhi’, ‘Jaipur’ and ‘Gujarat’ which are operational in the current year. M/s XYZ Ltd furnishes the following information for the month of July 2018 & asks to distribute the credit to various units.

(i) CGST paid on services used only for Delhi Unit: ` 300000/-

(ii) IGST, CGST & SGST paid on services used for all units: ` 1200000/-

(iii) Total Turnover of the units for the Financial Year 2017-18 are as follows:-

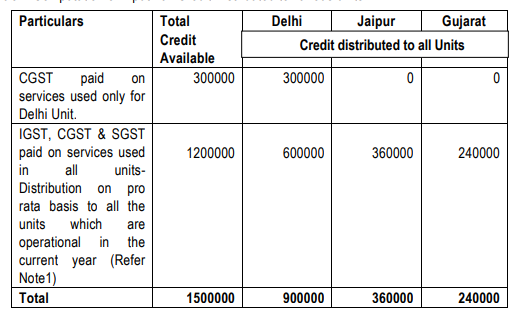

Solution: Computation of Input Tax Credit Distributed to various units: –

Note 1: Credit distributed pro rata basis based on the turnover of all the units are as under: –

(a) Unit Delhi: (50000000/100000000)*1200000 = ` 600000

(b) Unit Jaipur: (30000000/100000000)*1200000 = ` 360000

(c) Unit Gujarat: (20000000/100000000)*1200000 = ` 240000