OTHER METHODS :

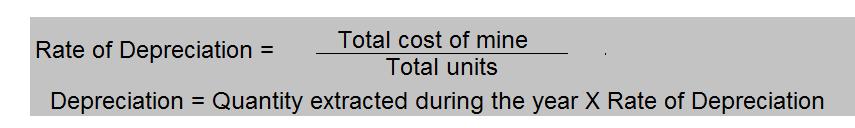

1. Depletion Method

This method is applicable in case of wasting assets, e.g. mines, quarries, oil well etc. from which a certain quantity of output is expected to be obtained.

Under this, depreciation is charged on the basis of output extracted in comparison with the estimated total contents of mine.

| ADVANTAGES | DISADVANTAGES |

| – It relates depreciation with the use of the asset. | – It is difficult to estimate the output correctly. |

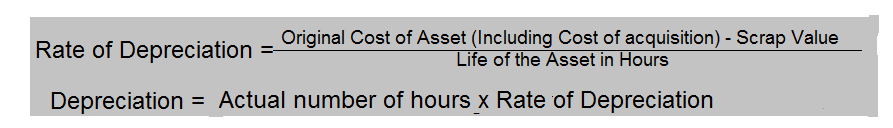

2. Machine Hour Rate Method (Service Hours Method)

Under Machine hour rate method, depreciation is allocated in proportion to the degree of asset used for production. The useful life of the asset is fixed in terms of hours. This method of depreciation can be charged on plant, machinery, vehicles etc.

| ADVANTAGES | DISADVANTAGES |

| Depreciation is related to actual working time of the asset. | This method can be used only when the life of the asset can be measured in terms of hours. |

3. Group Depreciation Method

Assets having same average life expectancy are grouped together. Depreciation is not charged for each item but is charged for the group as a whole.

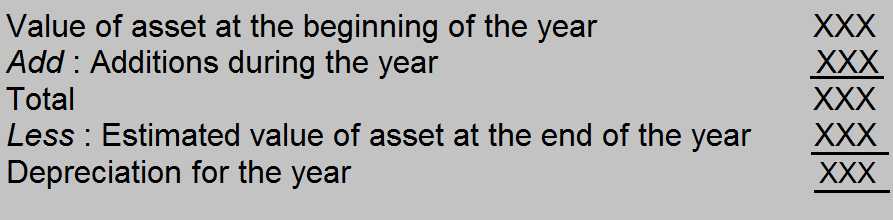

4. Inventory System of Depreciation

In case of assets of small value, the life of the asset cannot be accurately determined, e.g., loose tools, cattle etc. Depreciation in this case will be calculated as follows: