PROFIT AND LOSS APPROPRIATION ACCOUNT

As against the proprietorship business, the profits of the partnership firm are divided among partners in a given ratio. The profit has to be divided among the partners in the agreed profit sharing ratio after making necessary adjustments stated in the partnership deed such as interest on capitals, interest on drawings, salaries or/commission to partners, etc. For this purpose, an additional account is prepared, known as Profit and Loss Appropriation Account in which the net profit is transferred from Profit and Loss Account and necessary adjustments are made therein before the profit is divided among the partners. Following are the adjustments to be made in the profit & loss appropriation account:-

1. Interest on Capital

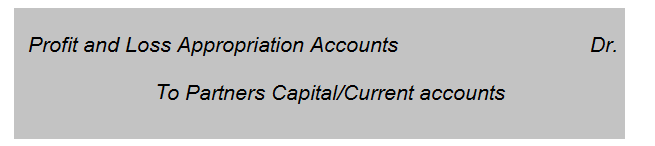

Where the profit sharing ratio is different from the ratio of capitals contributed by the partners, interest on capitals may be allowed to partners and charged against the profits of the firm to make the distribution of profits equitable. Interest on capital being an appropriation of profits, should be charged only out of the profits available. In case of loss, no interest on capital is provided. Interest is mostly calculated on the capitals at the commencement of the year. Where fresh capital has been introduced during the course of the year, interest is also allowed on this additional amount for the period for which the amount has been in business. Journal entry for interest on capital will be:

2. Interest on Drawings

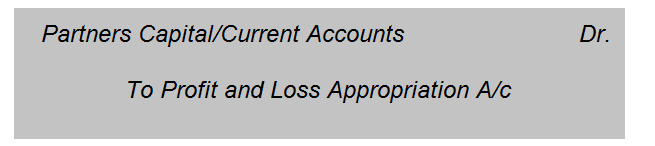

Interest may be charged on drawings made by partners to make distribution of profit more equitable. Interest on drawings should be charged on different amounts withdrawn for different periods. Journal entry for interest on drawing will be:

| Note: If a partner withdraws a fixed sum at the end of each month, the interest on his drawings for the year will be equal to the interest on his total drawings for a period of 5½ months.

If a partner withdraws the fixed amount in the middle of each month, interest will be calculated on his total drawings for a period of 6 months. If he withdraws the amount at the beginning of each month, interest will be calculated on his total drawings for the period of 6½ months. |

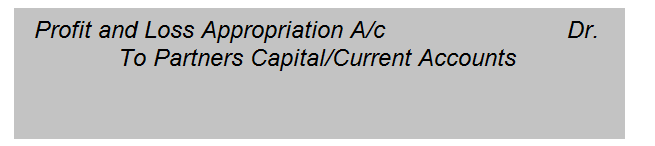

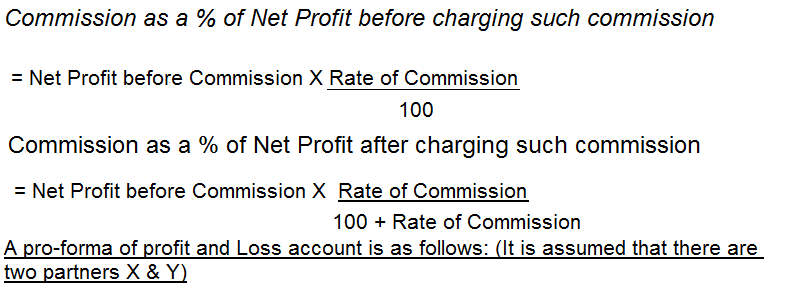

3. Salary or Commission Payable to Partners

If in a firm there are some active partners and some sleeping partners, the active partners may be allowed salary for the work. The payment of salaries is regarded as a distribution of part of the profit of the firm. Thus, the amount of profit is reduced before it is divided in the agreed profit sharing ratio. The accounting treatment is same when a partner is paid commission or bonus. Journal entry will be as follows:

SPECIMEN OF PROFIT AND LOSS APPROPRIATION ACCOUNT

Profit and Loss Appropriation Account

Dr . Cr.

|

Particulars |

Rs. | Rs. | Particulars | Rs. |

Rs. |

| To Interest on Capital : | By Profit and Loss Account | ||||

| X’s Capital/ Current A/c |

XXX |

(profit of the current year) |

XXX |

||

| Y’s Capital / Current A/c |

XXX |

XXX |

By Interest on drawings: | ||

| To Partners’ Salary: | X’s Capital /Current A/c |

XXX |

|||

| X’s Capital/ Current A/c |

XXX |

Y’s Capital/Current A/c |

XXX |

XXX |

|

| Y’s Capital / Current A/c |

XXX |

XXX |

By Loss transferred to: | ||

| To Partners’ Commission: | X’s Capital/ Current A/c |

XXX |

|||

| X’s Capital/ Current A/c |

XXX |

Y’s Capital/ Current A/c |

XXX |

XXX |

|

| Y’s Capital / Current A/c |

XXX |

XXX |

|||

| To Transfer to Reserve |

XXX |

||||

| To Profit transferred to: | |||||

| X’s Capital/ Current A/c |

XXX |

||||

| Y’s Capital/ Current A/c |

XXX |

XXX |

Note: – Interest on loan is charged against profit in Profit & Loss Account only. It is not the appropriation of profits.

4. Past Adjustments of Profit

Sometimes, amounts already distributed among the partners as profits or losses for a particular year require to be readjusted after the close of accounts for the year either due to discovery of some mistakes subsequent to the closing of the books or due to revision of certain condition of the partnership contract with retrospective effect. In such a case, the revenue accounts which have already been closed off are not reopened. Amounts already debited or credited to various partners are compared with the amounts which should have been debited or credited and an entry is passed for the difference to adjust the various accounts.

5. Guarantee of Profit to a Partner

Sometimes to induce a person to become a partner, a guarantee is given to him by other partners that his share of profits will not be below a certain figure. Usually when such a guarantee is given, it is also agreed that if in a year his share of profit exceeds the minimum limit, he would have to refund the excess in repayment of amount previously credited to him in excess of his normal share of profits. When such an agreement exists, first profits should be divided as if no guarantee has been given. Then, the amount by which the actual share falls short of the guaranteed share should be credited to the partner to whom the guarantee has been given and debited to other partners in their mutual profit sharing ratio. For recoupment of excess in subsequent years, a reverse entry will be passed.

Instead of all the partners, one partner may give the guarantee to a new partner that should the share of profits to the new partner fall below a certain figure; guarantor will make up the difference. In such case, the capital account of the partner in whose favour the guarantee is given will be credited and the capital account of the guarantor partner will be debited for the excess of the guaranteed amount over the actual share of the partner in whose favor guarantee has been given.

There can also be an arrangement that should profit due to the new partner exceed a certain figure, a particular partner, may bear the burden of such excess. It is really a guarantee to the other partners that the share of the new partner will not exceed a stipulated figure.

Illustration :

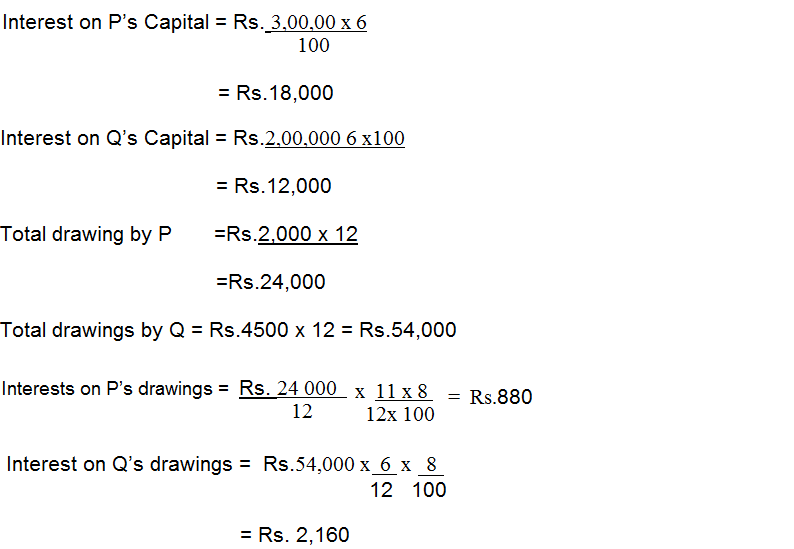

On 1st April, 2012 P and Q started business in partnership agreeing to share profits and losses equally. P contributed Rs.3,00,000 while Q contributed ` 2,00,000 by way of capital. It was agreed that interest be allowed on capital @6% per annum and charged on drawing @ 8% per annum. P withdrew ` 200 at the end of every month whereas Q withdrew Rs. 4,500 in the middle of every month.

Profits before the above noted adjustments for the year ended 31st March, 2013 amounted to Rs. 89,700. Show the necessary ledger accounts assuming:

(a) capital accounts are fluctuating

(b) capital accounts are fixed.

Solution:

(a) When capital accounts are fluctuating:

Profit and Loss Appropriation Account

Dr. Cr.

|

Particulars |

Rs. | Particulars |

Rs. |

| To Interest on Capital: | By Profit and Loss Account |

89,700 |

|

| P’s Capital A/c |

18,000 |

By Interest on drawings: | |

| Q’s Capital A/c |

12,000 |

P’s Capital A/c |

880 |

| To Profit transferred to: | Q’s Capital A/c |

2,160 |

|

| P’s Capital A/c (1/2 of Profit) |

31,370 |

||

| Q’s Capital A/c (1/2 of Profit) |

31,370 |

________ |

|

|

92,740 |

92,740 |

P’s Capital Account

Dr. Cr.

|

Date |

Particulars | Rs. | Date | Particulars |

Rs. |

|

2013 |

2012 |

||||

|

Mar. 31 |

To P’s Drawings A/c |

24,000 |

Apr.1 |

By Cash A/c |

3,00,000 |

|

Mar. 31 |

To Profits and Loss |

2013 |

By Profits and Loss | ||

| Appropriation A/c |

Mar. 31 |

Appropriation A/c | |||

| (Interest on Drawings) |

880 |

(Interest on Capital) |

18,000 |

||

|

Mar. 31 |

To Balance c/d |

3,24,490 |

Mar. 31 |

By Profits and Loss | |

|

_________ |

Appropriation A/c |

31,370 |

|||

|

3,49,370 |

3,49,370 |

||||

|

2013 |

|||||

|

Apr. 1 |

By Balance b/d |

3,24,490 |

Q’s Capital Account

Dr. Cr.

|

Date |

Particulars | Rs. | Date | Particulars |

Rs. |

|

2013 |

2012 |

||||

|

Mar. 31 |

To Q’s Drawings A/c |

54,000 |

Apr.1 |

By Cash A/c |

2,00,000 |

|

Mar. 31 |

To Profits and Loss |

2013 |

By Profits and Loss | ||

| Appropriation A/c |

Mar. 31 |

Appropriation A/c | |||

| (Interest on Drawings) |

2,160 |

(Interest on Capital) |

12,000 |

||

|

Mar. 31 |

To Balance c/d |

1,87,210 |

Mar. 31 |

By Profits and Loss | |

|

_________ |

Appropriation A/c |

31,370 |

|||

|

2,43,370 |

2,43,370 |

||||

|

2013 |

|||||

|

Apr. 1 |

By Balance b/d |

1,87,210 |

(b) When capital accounts are fixed:

Profit and Loss Appropriation Account

Dr. Cr.

|

Particulars |

Rs. | Particulars |

Rs. |

| To Interest on Capital : | By Profit and Loss Account |

89,700 |

|

| P’s Current A/c |

18,000 |

By Interest on drawings: | |

| Q’s Current A/c |

12,000 |

P’s Current A/c |

880 |

| To Profit transferred to: | Q’s Current A/c |

2,160 |

|

| P’s Current A/c (1/2 of Profit) |

31,370 |

||

| Q’s Current A/c (1/2 of Profit) |

31,370 |

_______ |

|

|

92,740 |

92,740 |

P’s Capital Account

Dr. Cr.

|

Date |

Particulars | Rs. | Date | Particulars |

Rs. |

|

2013 |

2012 |

||||

|

Mar. 31 |

To Balance c/d |

3,00,000 |

Apr.1 |

By Cash A/c |

3,00,000 |

|

2013 |

|||||

|

Apr.1 |

By Balance b/d |

3,00,000 |

Q’s Capital Account

Dr. Cr.

|

Date |

Particulars | Rs. | Date | Particulars |

Rs. |

| 2013 | 2012 | ||||

| Mar. 31 | To Balance c/d |

2,00,000 |

Apr.1 | By Cash A/c |

2,00,000 |

| 2013 | |||||

| Apr.1 | By Balance b/d |

2,00,000 |

P’s Current Account

Dr. Cr.

| Date | Particulars | Rs. | Date | Particulars | Rs. |

| 2013 | 2013 | ||||

| Mar. 31 | To P’s Drawings A/c |

2,400 |

Mar. 31 |

By Profits and Loss | |

| Mar. 31 | To Profits and Loss | Appropriation A/c | |||

| Appropriation A/c | (Interest on Capital) |

18,000 |

|||

| (Interest on Drawings) |

880 |

Mar. 31 |

By Profits and Loss | ||

| Appropriation A/c |

31,370 |

||||

| Mar. 31 | To Balance c/d |

24,490 |

|||

|

49,370 |

49,370 |

||||

|

2013 |

By Balance b/d |

24,490 |

|||

|

Apr. 1 |

Q’s Current Account

Dr. Cr.

|

Date |

Particulars | Rs. | Date | Particulars |

Rs. |

|

2013 |

2013 |

||||

|

Mar. 31 |

To Q’s Drawings A/c |

54,000 |

Mar. 31 |

By Profits and Loss | |

|

Mar. 31 |

To Profits and Loss | Appropriation A/c | |||

| Appropriation A/c | (Interest on Capital) |

12,000 |

|||

| (Interest on Drawings) |

2,160 |

Mar. 31 |

By Profits and Loss | ||

| Appropriation A/c |

31,370 |

||||

|

________ |

Mar. 31 |

By Balance c/d |

12,790 |

||

|

56,160 |

56,160 |

||||

|

2013 |

|||||

| Apr.1 | To Balance b/d |

12,790 |

Illustration:

On 1st April, 2013 the capital accounts of A, B and C stood at Rs.30,000, Rs.20,000 and Rs.

10,000 respectively. They shared profits and losses equally. Profit and Loss account for the year ended 31 March, 2013 revealed a net profit of `12, 000 which was transferred to capital accounts of the partners equally.

It was decided in April 2013 that profits should be distributed equally after allowing interests on capital @ 6% per annum with effect from 1st April, 2012. While going through the books of account for 2012-13 it was discovered that repair charges for A’s personal scooter amounting to ` 90 had been charged to Repairs Account.

Show the journal entries necessary to adjust the current account of the partners.

per annum with effect from 1st April, 2012. While going through the books of account for 2012-13 it was discovered that repair charges for A’s personal scooter amounting to ` 90 had been charged to Repairs Account.

Show the journal entries necessary to adjust the current account of the partners.

Solution:

|

Rs. |

Rs. |

||

| Profits as already distributed |

12,000 |

||

| Add: Repair charges to be charged to A’s Current Account |

____90____ |

||

|

12,090 |

|||

| Less : Interest on: | |||

| A’s Capital |

1,800 |

||

| B’s Capital |

1,200 |

||

| C’s Capital |

___600__ |

3,600 |

|

| Net profit after adjustment |

8,490 |

||

| Each partner will get Z 8,490 = Z 2,830

3 |

|||

| Revised Distribution | |||

|

A |

B |

C |

|

|

Rs. |

Rs. |

Rs. |

|

| Net Profit |

2,830 |

2,830 |

2,830 |

| Interest of Capital |

1,800 |

1,200 |

600 |

|

4,630 |

4,030 |

4,430 |

|

| Less : Repair charges |

90 |

— |

— |

|

4,540 |

4,030 |

3,430 |

|

| Distribution as already made of Z 12,000 |

4000 |

4000 |

4000 |

| Net Adjustment to be made |

+540 |

+30 |

— 570 |

| particulars | Rs. | Rs. |

| C’s Current Account Dr. | 570 | |

| To A’s Current Account | 540 | |

| To B’s Current Account | 30 | |

| (Adjustment effected for change on the basis of distribution of profit for 2010-11 and error located in the accounts for 2010-11) |

Illustration :

C and D were sharing profits in the ratio of 3:1. Profits as per books for 2012-13 amounted to Rs.40,000. In April 2013, they agreed to change the profit sharing ratio to 5:3 with retrospective effect from 1st April, 2012. It was found that outstanding expenses of Rs.4,000 as on 31st March, 2012 and outstanding expenses of Rs. 3,000 as on 31st March, 2013 had not been taken into account while drawing up the final accounts for 2011-12 and 2012-13. Also by mistake interest on drawings had been ignored while preparing the accounts for 2012-13 such interest being Rs.600 on C’s drawings and Rs.300 on D’s drawings. Pass the necessary journal entries to adjust the capitals of partners.

Solution:

Working Notes:

C D

Old ratio 3:1 or 6 : 2

New Ratio 5 : 3

D gets 1/8 more

C D

Rs. Rs.

Old distribution of Z 40,000 (A) 30,000 Cr. 10,000 Cr.

New distribution of Z 40,000 +

Rs. 600 +Rs. 300 or Rs. 40,900

in the ratio of 5 : 3 25 562.50 Cr. 15 337.50 Cr.

Interest on Drawings 600 Dr. 300 Dr.

(B) 24 962.50 (Net) Cr. 15 037.50 (Net) Cr.

Difference (A) — (B) 5,037.50 Dr. 5,037.50 Cr.

Outstanding expenses of Rs. 4,000 as on 31st March, 2012 will be debited to partners’ capital accounts in the old ratio (to raise Outstanding Expenses Account) and then will be credited to partners’ capital accounts in the new ratio (to write off Outstanding Expenses Account). Outstanding Expenses of ` 3,000 will be debite to capital accounts in the new ratio and credited to Outstanding Expenses Account. In the entry shown below, only the net effect has been recorded:

| Particulars | Rs. | Rs. |

| C’s Capital Account Dr. | 2,375* | |

| D’s Capital Account Dr. | 625* | |

| To Outstanding Expenses Account | 3,000 | |

| (Adjustment entry for outstanding expenses of Rs. 4,000 as on 31st March, 2012 and of Rs. 3,000 as on 31st March, 2013) |

| C’s Capital Account Dr. | 5,037.50 | |

| To D’s Capital Accountx | 5,037.50 | |

| (Entry to adjust capital accounts on redistribution of profit for 2012-13) |

| * 31.3.2012 (Ratio 3 : 1)

1.4.2012 (Ratio 5 : 3) 31.3.2013 (Ratio 5 : 3) |

C Dr. 3,000 Cr. 2,500 Dr. 1,875 Dr. 2.375 |

D Dr. 1,000 Cr. 1,500 Dr. 1,125 Dr. 625 |

Note: If capital accounts are fixed, current accounts will be debited and credited instead of capital accounts.

Illustration :

With effect from 1st April, 2012, D, the manager in the firm of A, B, and C who were sharing profits and losses in the ratio of 5:3:2 respectively was admitted as a partner in the firm with 1/11th share of profit. It was agreed that should D’ share of profits exceed his remuneration as the manager, A will bear the burden of such an excess. The manager D was entitled to a salary of r 10,000 p.m. plus a commission of 2% of net profit remaining after charging his salary but before charging his commission.

Profit and Loss Account for the year ended 31st March, 2013 showed a profit of r 22,00,000. Show how the profit will be distributed among the four partners.

Solution:

The main point is that B and C are not to suffer due to D’s becoming a partner. Suppose, D is still the manager; then:

|

Rs. |

||

| Profit as given |

22,00,000 |

|

| Less: Salary which D would have received |

1,20,000 |

|

|

20,80,000 |

||

| Less: D’s commission @ 2% on Z 20,80,000 |

41,600 |

|

| Net profit |

20,38,400 |

|

A (5/10) |

B (3/10) |

C (2/10) D (as Manager) |

| Distribution 10,19,200 |

6,11,520 |

4,07,680 1,61,600 |

Under the new arrangement D will receive 1/11th of Z 22,00,000 i.e., Z 2,00,000. It means that D will get Z 38,400 more than what he would have got as manager. This will be deducted from A’s share. Hence, the profit of Z 22,00,000 will be distributed as follows:

|

A |

Rs. 9,80,800 |

|

B |

Rs. 6,11,520 |

|

C |

Rs. 4,07,680 |

|

D |

Rs. 2,00,000 |

Illustration :

P and S were in partnership sharing profits and losses in the ratio of 7:3 respectively. As a mark of appreciation of the services of their manager Z, they admitted him into partnership on 1st April, 2012 giving him 1/10th share of the future profits; the mutual ratio between P and S remaining unchanged. Before becoming a partner, Z was getting a salary of r 4,000 per month and a commission of 5% on the net profits remaining after charging his salary and commission. It was agreed that any excess over his former remuneration to which Z as a partner becomes entitled will be provided out of P’s share of profit.

The net profit for the year ended 31st March, 2013 amounted to r 19,80,000. Prepare the profit and loss appropriation account for the year ended 31st March, 2012 showing the distribution of the profits of the net profits amongst the partners. Show your working notes clearly.

Solution:

In the books of P, S and Z

Profits and Loss Appropriation Account

Dr. for the year ended 31st March,2013 Cr.

|

Particulars |

Rs. | Particulars |

Rs. |

||||

| To Profit transferred to Capital Accounts: | By Net profit b/d |

19,80,000 |

|||||

|

P |

12,30,000 |

||||||

|

S |

5,52,000 |

||||||

|

Z |

1,98,000 |

________________ |

|||||

|

19,80,000 |

19,80,000 |

| 194 FP-FA&A

Working Notes: |

Z | Z |

| (1) Z’s share: 1/10 of Z 19, 80,000 | 1, 98,000 | |

| Less: Z’s share as manager: | ||

| Salary: Z 4,000 x 12 | 48,000 | |

| ■ | ||

| Commission: ( 5 of Z 1,98,000-48,000 | 92,000 | 1, 40,000 |

| 105 | ||

| Excess amount chargeable to P | 58,000 | |

| (2) When Z acted as manager, divisible profit of the old partner would have been (Z 19,80,000 — Z 1,40,000) | 18,40,000 | |

| P’s share of profit would have been | ||

| ( 7 of Z 18,40,000) | 12,88,000 | |

| 10 | ||

| S’s share of profits would have been | ||

| ( 3 of Z 18,40,000) | 5,52,000 | |

| 10 | ||

| (3) When Z becomes a partner, share of profit of each: | ||

| P (Z 12,88,000 — Z 58,000) | 12,30,000 | |

| S | 5, 52,000 | |

| Z | 1, 98,000 | |

| 19, 80,000 |

Alternatively, the final distribution of profit can be arrived at as follows:

Profit and Loss Appropriation Account

Dr. Cr.

|

Particulars |

Rs. | Particulars |

Rs. |

||

| To Z’s Capital A/c (1/10) |

1,98,000 |

By Net Profit b/d |

19,80,000 |

||

| To Balance c/d |

17, 82,000 |

||||

|

19,80,000 |

19,80,000 |

||||

| To P’s Capital A/c (7/10) |

12,88,000 |

By Balance c/d |

17,82,000 |

||

| To S’s Capital A/c (3/10) |

5,52,000 |

By P’s Capital A/c |

58,000 |

||

|

18, 40,000 |

18,40,000 |

||||

Final Distribution

|

Rs. |

|||

| P=Z 12,88,000 |

– Z58,000 |

= |

12,30,000 |

| S |

= |

5,52,000 |

|

| Z |

= |

1,98,000 |

|

|

19,80,000 |