Relevant Notifications for RCM on Goods :

NN 04/2017-CT (rate) & IT (rate) dated 28.06.2017 read with NN 36/2017-CT(rate) & NN 37/2017-IT (rate) dated 22.09.2017 and NN 43/2017-CT (rate) & NN 45/2017-CT (rate) dated 14.11.2017

1. Cashew nuts, not shelled or peeled

2. Bidi wrapper leaves (tendu)

3. Tobacco leaves

4. Silk yarn

5. Used vehicles, seized and confiscated goods, old and used goods, waste and scrap, supplied by Central Government, State Government, Union territory or a local authority to any registered person

6. Raw Cotton (w.e.f. 15th November’ 2017)

Details of inward supply of taxable goods/services effected from unregistered persons liable to tax under reverse charge mechanism u/s 9(4) of the CGST Act, read with Section 5(4) of the IGST Act, on which tax has not been remitted.

Section 9(4) of the CGST Act: The central tax in respect of the supply of taxable goods or services or both by a supplier, who is not registered, to a registered person shall be paid by such person on reverse charge basis as the recipient and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

Section 5(4) of the IGST Act: On similar line with Section 9(4) of the CGST Act as given supra.

However, for Financial Year 2017-18, Section 9(4) of the CGST Act and Section 5(4) of the IGST Act is applicable till 12.10.2017.

Whether any exemption notifications or special orders under the Act are applicable to the registered person? Provide summary details

Section 11: Power to grant exemption

Where the Government is satisfied that it is necessary in the public interest so to do, it may, on the recommendations of the Council, by notification, exempt generally, either absolutely or subject to such conditions as may be specified therein, goods or services or both of any specified description from the whole or any part of the tax leviable thereon with effect from such date as may be specified in such notification.

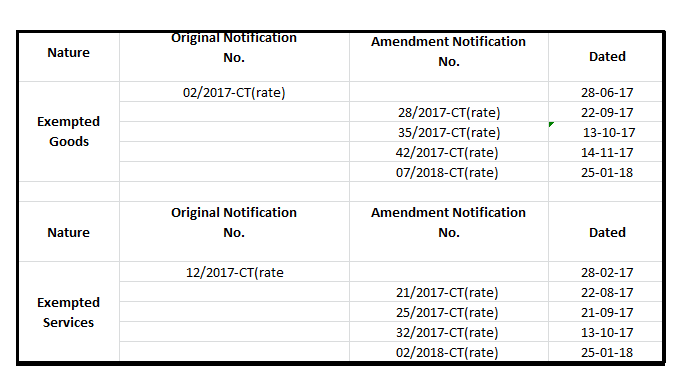

Exemption Notification