Residential Status [Section 6] :

The incidence of tax on any assessee depends upon his residential status under the Act. Therefore, after determining whether a particular amount is capital or revenue in nature, if the receipt is of a revenue nature and chargeable to tax, it has to be seen whether the assessee is liable to tax in respect of that income. The taxability of a particular receipt would thus depend upon not only the nature of the income and the place of i ts accrual or receipt but also upon the assessee‟s residential status.

For all purposes of income-tax, individual and HUF taxpayers are classified into three broad categories on the basis of their residential status. viz

(1) Resident and ordinarily resident

(2) Resident but not ordinarily resident

(3) Non-resident

The residential status of an assessee must be ascertained with reference to each previous year. A person who is resident and ordinarily resident in one year may become non-resident or resident but not ordinarily resident in another year or vice versa. Persons other than individuals and HUFs can be either resident or non resident. The provisions for determining the residential status of assessees are:

(1) Residential status of Individuals: Under section 6(1), an individual is said to be resident in India in any previous year, if he satisfies any one of the following conditions:

(i) He has been in India during the previous year for a total period of 182 days or more, or

(ii) He has been in India during the 4 years immediately preceding the previous year for a total period of 365 days or more and has been in India for at least 60 days in the previous year. If the individual satisfies any one of the conditions mentioned above, he is a resident. If both the above conditions are not satisfied, the individual is a non-resident.

Note:

(a) The term “stay in India” includes stay in the territorial waters of India (i.e. 12 nautical miles into the sea from the Indian coastline). Even the stay in a ship or boat moored in the territorial waters of India would be sufficient to make the individual resident in India. (b) It is not necessary that the period of stay must be continuous or active nor is it essential that the stay should be at the usual place of residence, business or employment of the individual.

(c) For the purpose of counting the number of days stayed in India, both the date of departure as well as the date of arrival are considered to be in India.

(d) The residence of an individual for income-tax purpose has nothing to do with citizenship, place of birth or domicile. An individual can, therefore, be resident in more countries than one even though he can have only one domicile.

Exceptions:

The following categories of individuals will be treated as residents only if the period of their stay during the relevant previous year amounts to 182 days. In other words even if such were in India for 365 days during the 4 preceding years and 60 days in the relevant previous year, they will not be treated as resident.

(1) Indian citizens, who leave India in any previous year as a member of the crew of an Indian ship or for purposes of employment outside India, or

(2) Indian citizen or person of Indian origin*1 engaged outside India in an employment or a business or profession or in any other vocation, who comes on a visit to India in any previous year. Thus, under section 6(1), the conditions to be satisfied by an individual to be a resident in India are provided. The residential status is determined on the basis of the number of days of his stay in India during a previous year.

However, in case of foreign bound ships where the destination of the voyage is outside India, there is uncertainty regarding the manner and the basis of determining the period of stay in India for an Indian citizen, being a crew member. To remove this uncertainty, Explanation 2 has been inserted to section 6(1) to provide that in the case of an Individual, being a citizen of India and a member of the crew of a foreign bound ship leaving India, the period or periods of stay in India shall, in respect of such voyage, be determined in the prescribed manner and subject to the prescribed conditions. Accordingly, the CBDT has vide, Notification No.70/2015 dated 17.8.2015, inserted Rule 126 in the Income-tax Rules, 1962 to compute the period of stay in such cases. According to Rule 126, for the purposes of section 6(1), in case of an individual, being a citizen of India and a member of the crew of a ship, the period or periods of stay in India shall, in respect of an eligible voyage, not include the following period:

Period to be excluded

| Period commencing from

|

Period ending on | |

| the date entered into the Continuous Discharge Certificate in respect of |

and

|

the date entered into the Continuous Discharge Certificate in respect of |

A person is said to be of Indian origin if he or either of his parents or either of his grandparents were born in undivided India.

| joining the ship by the said individual for the eligible voyage.

|

signing off by that individual from the ship in respect of such voyage.

|

Meaning of certain terms:

| Terms

|

Meaning |

| (a) Continuous

Discharge Certificate |

This term has the meaning assigned to it in the Merchant Shipping

(Continuous Discharge Certificate-cum Seafarer’s Identity Document) Rules, 2001 made under the Merchant Shipping Act, 1958. |

| (b) Eligible

voyage |

A voyage undertaken by a ship engaged in the carriage of passengers or

freight in international traffic where – (i) for the voyage having originated from any port in India, has as its destination any port outside India; and (ii) for the voyage having originated from any port outside India, has as its destination any port in India.’. |

Not-ordinarily resident – Only individuals and HUF can be resident but not ordinarily resident in India. All other classes of assessees can be either a resident or non-resident. A notordinarily resident person is one who satisfies any one of the conditions specified under section 6(6).

(i) If such individual has been non-resident in India in any 9 out of the 10 previous years preceding the relevant previous year, or

(ii) If such individual has during the 7 previous years preceding the relevant previous year been in India for a period of 729 days or less.

Note: In simpler terms, an individual is said to be a resident and ordinarily resident if he satisfies both the following conditions:

(i) He is a resident in any 2 out of the last 10 years preceding the relevant previous year, and

(ii) His total stay in India in the last 7 years preceding the relevant previous year is 730 days or more. If the individual satisfies both the conditions mentioned above, he is a resident and ordinarily resident but if only one or none of the conditions are satisfied, the individual is a resident but not ordinarily resident.

Illustration 1

Steve Waugh, the Australian cricketer comes to India for 100 days every year. Find out his residential status for the A.Y. 2016-17.

Solution

For the purpose of his residential status in India for A.Y. 2016-17, the relevant previous year is 2015-16.

Step 1: The total stay of Steve Waugh in the last 4 years preceding the previous year is 400 days (i.e.,100 × 4) and his stay in the previous year is 100 days. Therefore, since he has satisfied the second condition in section 6(1), he is a resident.

Step 2: Since his total stay in India in the last 7 years preceding the previous year is 700 days (i.e., 100 × 7), he does not satisfy the minimum requirement of 730 days in 7 years. Any one of the conditions not being satisfied, the individual is resident but not ordinarily resident. Therefore, the residential status of Steve Waugh for the assessment year 2016-17 is resident but not ordinarily resident.

Illustration 2

Mr. B, a Canadian citizen, comes to India for the first time during the P.Y.2011-12. During the financial years 2011-12, 2012-13, 2013-14, 2014-15 and 2015-16, he was in India for 55 days, 60 days, 90 days, 150 days and 70 days, respectively. Determine his residential status for the A.Y.2016-17.

Solution

During the previous year 2015-16, Mr. B was in India for 70 days and during the 4 years preceding the previous year 2015-16, he was in India for 355 days (i.e. 55 + 60 + 90 + 150 days).

Thus, he does not satisfy section 6(1). Therefore, he is a non-resident for the previous year 2015-16.

Illustration 3

Mr. C, a Japanese citizen left India after a stay of 10 years on 1.06.2013. During the financial year 2014-15, he comes to India for 46 days. Later, he returns to India for 1 year on 10.10.2015. Determine his residential status for the A.Y. 2016-17.

Solution

During the previous year 2015-16, Mr. C was in India for 174 days (i.e. 22 + 30 + 31+ 31+ 29 + 31 days). His stay in the last 4 years is:

| 2014-15

|

– 46 | |

| 2013-14

|

– 62 | (i.e. 30 + 31 + 1) |

| 2012-13 | – 365

|

(since he left India on 1.6.2013 after 10 years) |

| 2011-12 | – 365

|

(since he left India on 1.6.2013 after 10 years) |

| Total

|

838 |

Mr. C is a resident since his stay in the previous year 2015-16 is 174 days and in the last 4 years is more than 365 days. For the purpose of being ordinarily resident, it is evident from the above calculations, that

(i) his stay in the last 7 years is more than 729 days and

(ii) since he was in India for 10 years prior to 1.6.2013, he was a resident in at least 2 out of the last 10 years preceding the relevant previous year. Therefore, Mr.C is a resident and ordinarily resident for the A.Y.2016-17.

Illustration 4

Mr. D, an Indian citizen, leaves India on 22.9.2015 for the first time, to work as an officer of a company in France. Determine his residential status for the A.Y. 2016-17.

Solution

During the previous year 2015-16, Mr. D, an Indian citizen, was in India for 175 days (i.e., 30+ 31+30+31+31+22 days). He does not satisfy the minimum criteria of 182 days. Also, since he is an Indian citizen leaving India for the purposes of employment, the second condition under section 6(1) is not applicable to him. Therefore, Mr. D is a non-resident for the A.Y.2016-17.

(2) Residential status of HUF: A HUF would be resident in India if the control and management of its affairs is situated wholly or partly in India. If the control and management of the affairs is situated wholly outside India it would become a non-resident.

The expression „control and management‟ referred to under section 6 refers to the central control and management and not to the carrying on of day-to-day business by servants, employees or agents. The business may be done from outside India and yet its control and management may be wholly within India. Therefore, control and management of a business is said to be situated at a place where the head and brain of the adventure is situated. The place of control may be different from the usual place of running the business and sometimes even the registered office of the assessee. This is because the control and management of a business need not necessarily be done from the place of business or from the registered office of the assessee. But control and management do imply the functioning of the controlling and directing power at a particular place with some degree of permanence. If the HUF is resident, then the status of the Karta determines whether it is resident and

ordinarily resident or resident but not ordinarily resident. If the karta is resident and ordinarily resident, then the HUF is resident and ordinarily resident and if the karta is resident but not ordinarily resident, then HUF is resident but not ordinarily resident.

Illustration 5

The business of a HUF is transacted from Australia and all the policy decisions are taken there. Mr. E, the karta of the HUF, who was born in Kolkata, visits India during the P.Y.2015 – 16 after 15 years. He comes to India on 1.4.2015 and leaves for Australia on 1.12.2015. Determine the residential status of Mr.E and the HUF for A.Y. 2016-17.

Solution

(a) During the P.Y.2015-16, Mr. E has stayed in India for 245 days (i.e. 30+31+30+31+31+ 30+31+30+1 days). Therefore, he is a resident. However, since he has come to India after 15 years, he cannot satisfy any of the conditions for being ordinarily resident. Therefore, the residential status of Mr. E for the P.Y.2015-16 is resident but not ordinarily resident.

(b) Since the business of the HUF is transacted from Australia and nothing is mentioned regarding its control and management, it is assumed that the control and management is also wholly outside India. Therefore, the HUF is a non-resident for the P.Y.2015-16.

(3) Residential status of firms and association of persons: A firm and an AOP would be resident in India if the control and management of its affairs is situated wholly or partly in India. Where the control and management of the affairs is situated wholly outside India, the firm would become a non-resident.

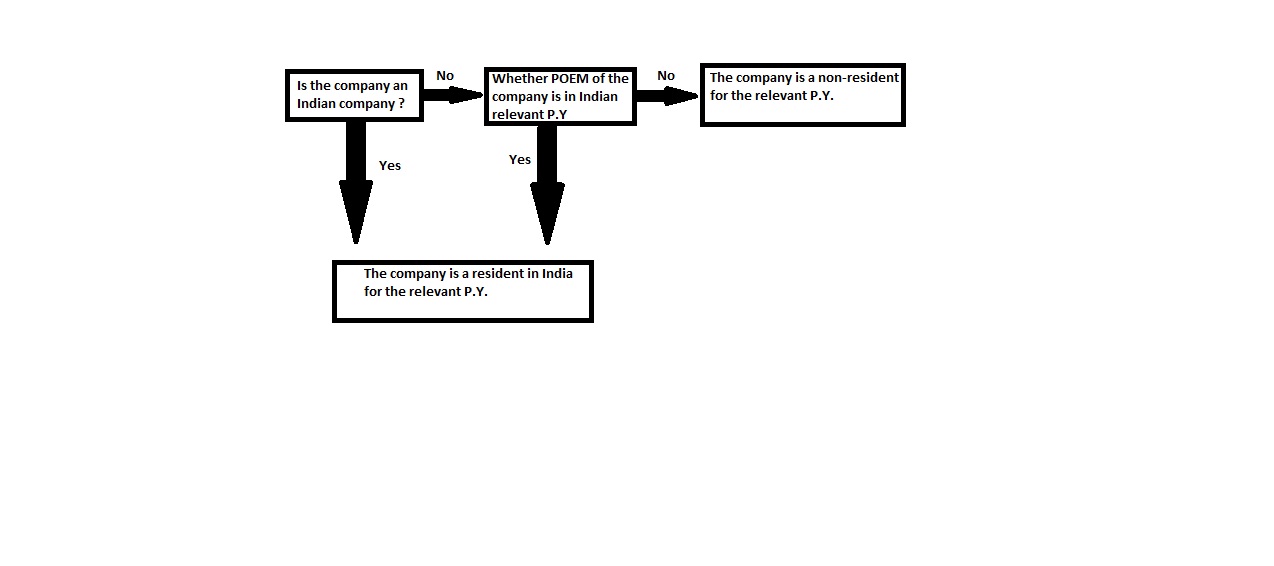

(4) Residential status of companies: A company would be resident in India in any previous year, if-

(i) it is an Indian company; or

(ii) its place of effective management, in that year, is in India. Explanation to section 6(3) defines “place of effective management” to mean a place where key management and commercial decisions that are necessary for the conduct of the business of an entity as a whole are, in substance made.

Determination of residential status of a company

A set of principles to be followed in determination of POEM would be issued for the guidance of the taxpayers as well as, tax administration.

(5) Residential status of local authorities and artificial juridical persons: Local authorities and artificial juridical persons would be resident in India if the control and management of its affairs is situated wholly or partly in India. Where the control and management of the affairs is situated wholly outside India, they would become non-residents.