Statement of Affairs Method :

The following procedures are adopted to calculate profit.

Step 1 → Ascertain opening capital: A statement of affairs at the beginning of the year is prepared to find out the amount of

capital in the beginning. A statement affairs is like a Balance sheet. The difference between assets and liabilities side represents “Opening Capital”.

Format of statement of affairs

| Liabilities | Rs. | Assets | Rs. |

| Sundry Creditors | xxxx | Cash in Hand | xxxx |

| Bills Payable | xxxx | Cash at Bank | xxxx |

| Outstanding Expenses | xxxx | Sundry Debtors | xxxx |

| Bank Overdraft | xxxx | Bills Receivable | xxxx |

| Capital (Balancing figure) | xxxx | Stock in trade | xxxx |

| Prepaid Expenses | xxxx | ||

| Fixed Assets | xxxx | ||

| xxxx | xxxx |

Step 2 → Ascertainment Closing Capital: Prepare a statement of affairs (after all adjustments*) at the end of the accounting period, to ascertain closing capital.

Step 3 → Add the amount of drawings (whether in cash or in kind) to the closing capital.

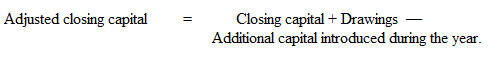

Step 4 → Deduct the amount of Additional Capital introduced, from the above, to get Adjusted capital.

Step 5 → Ascertainment profit or loss by deducting opening capital from the adjusted closing capital.

* Adjustments: Depreciation, interest on capitals, interest on drawings, Provision for Bad debts etc.

Statement of Profit or Loss for the year ______

Closing Capital x x x

Add: Drawings x x x

x x x

Less: Additional capital introduced x x x

Adjusted closing capital x x x

Less: Opening capital x x x

Net Profit or loss for the year x x x

Note : If adjusted closing capital is more than opening capital = Profit

If adjusted closing capital is less than opening capital = Loss

Illustration :

Find out profit or loss from the following information.

Rs.

Opening Capital 4,00,000

Drawings 90,000

Closing Capital 5,00,000

Additional Capital during the year 30,000

Solution:

Statement of profit or loss

Rs.

Closing capital 5,00,000

Add: Drawings 90,000

5,90,000

Less: Additional Capital 30,000

Adjusted closing capital 5,60,000

Less: Opening capital 4,00,000

Profit for the year 1,60,000

Illustration :

Calculate the missing information from the following.

|

Profit made during the year Capital at the end Additional Capital introduced during the year Drawings Capital in the beginning

|

Rs. 4,800 ? 4,000 9,600 |

Solution:

Rs.

Closing capital (Balancing figure) 16,000

Add: Drawings 2,400

18,400

Less: Additional Capital 4,000

Adjusted closing capital 14,400

Less: Opening capital 9,600

Profit made during the year 4,800

Ans: Capital at the end Rs.16,000

Note:

Step 1 → Add Profit of Rs.4,800 with opening capital Rs.9,600 = Adjusted closing capital Rs.14,400.

Step 2 →Add Additional capital of Rs.4,000 with Adjusted closing capital Rs.14,400 = Rs.18,400

Step 3 →Deduct drawings Rs.2,400 from the total amount arrived (Step 2) Rs. 18,400 = Closing capital Rs.16,000.

Illustration : 3

Mr. Suresh started business with Rs.2,00,000 on 1st April 2003. His books are kept under single entry. On 31st March, 2004 his position ws as under:

|

Liabilities |

Rs. | Assets |

Rs. |

| Sundry Creditors |

40,000 |

Cash in Hand |

6,000 |

| Bills Payable |

5,000 |

Cash at Bank |

10,000 |

| Outstanding creditors |

7,500 |

Furniture |

30,000 |

| Plant & Machinery |

1,00,000 |

||

| Sundry Debtors |

50,000 |

||

| Stock |

90,000 |

||

| Bills Receivable |

15,000 |

Ascertain the profit or loss made by Mr.Suresh for the year ended 31st March 2004.

Solution:

Calculation of closing capital:

Statement of affairs of Mr.Suresh as on 31.3.2004

| Liabilities | Rs. | Assets | Rs. |

| Sundry creditors | 40,000 | Cash in hand | 6,000 |

| Bills payable | 5,000 | Cash at Bank | 10,000 |

| Outstanding creditors | 7,500 | Furniture | 30,000 |

| Closing capital(Balancing figure) | 2,48,500 | Plant & Machinery | 1,00,000 |

| Sundry Debtors | 50,000 | ||

| Stock | 90,000 | ||

| Bills receivable | 15,000 |

| 3,01,000 | 3,01,000 |

Statement of profit or loss for the year ended 31.3.2004

Rs.

| Closing capital |

2,48,500 |

| Less: Opening capital |

2,00,000 |

| Profit for the year |

48,500 |

Illustration :

Prakash keeps his books by ‘Single Entry System’. His position on 1.4.2003 and 31.3.2004 was as follows:

| 1.4.2003 | 31.3.2004 | |

| Rs. | Rs. | |

| Cash | 500 | 6,000 |

| Bank Balance | 10,000 | 15,000 |

| Stock | 7,000 | 10,000 |

| Sundry Debtors | 30,000 | 40,000 |

| Furniture | 6,000 | 6,000 |

| Sundry Creditors | 6,000 | 12,000 |

He introduced an additional capital of Rs.8,000 during the financial year. He withdrew Rs.14,000 for domestic purpose. Find out the profit for the year ended 31.3.2004.

Solution:

i) Calculation of opening capital:

Statement of affairs of Mr.Prakash as on 1.4.2003

|

Liabilities |

Rs. | Assets |

Rs. |

| Sundry creditors |

6,000 |

Cash |

500 |

| Bank Balance |

10,000 |

||

| Stock |

7,000 |

||

| Sundry Debtors |

30,000 |

||

| Furniture |

6,000 |

||

| Opening Capital |

47,500 |

||

| (Balancing figure) | |||

|

53,500 |

53,500 |

ii) Calculation of Closing Capital:

Statement of affairs of Mr.Prakash as on 31.3.2004

|

Liabilities |

Rs. | Assets |

Rs. |

| Sundry creditors |

12,000 |

Cash |

6,000 |

| Bank Balance |

15,000 |

||

| Stock |

10,000 |

||

| Sundry Debtors |

40,00 0 |

||

| Furniture |

6,000 |

||

| Closing capital |

65,000 |

||

| (Balancing figure) | |||

|

77,000 |

77,000 |

Statement of Profit or Loss for the period ended 31.3.2004

Closing capital 65,000

Add: Drawings 14,000

79,000

Less: Additional capital 8,000

Adjusted closing capital 71,000

Less: Opening capital 47,500

Profit for the year 2003-2004 23,500

Illustration :

Mrs. Vanitha keeps her books on singly entry basis. Find out the profit or loss made for the period ending 31.3.2004.

| Assets & Liabilities | 1.4.2003 | 31.3.2004 |

| Rs. | Rs. | |

| Bank Balance | 3,500 (Cr.) | 4,500 (Dr.) |

| Cash on hand | 200 | 300 |

| Stock | 3,000 | 4,000 |

| Sundry Debtors | 8,500 | 7,600 |

| Plant | 20,000 | 20,000 |

| Furniture | 10,000 | 10,000 |

| Sundry Creditors | 15,000 | 18,000 |

Mrs.Vanitha had withdrawn Rs.10,000 for her personal use and had introduced fresh capital of Rs.4,000. A provision of 5% on debtors is necessary. Write off depreciation on plant at 10% and furniture at 15%.

Solution:

i) Calculation of Opening Capital:

Statement of affairs of Mrs.Vanitha as on 1.4.2003

|

Liabilities |

Rs. | Assets |

Rs. |

| Bank Balance (0/d) |

3,500 |

Cash on hand |

200 |

| Sundry Creditors |

15,000 |

Stock |

3,000 |

| Sundry Debtors |

8,500 |

||

| Plant |

20,000 |

||

| Opening capital |

23,200 |

Furnitue |

10,000 |

| (Balancing figure) | |||

|

41,700 |

41,700 |

ii) Calculation of closing capital

Statement of affairs of Mrs.Vanitha as on 31.3.2004

|

Liabilities |

Rs. | Rs. | Assets | Rs. |

Rs. |

| Sundry Creditors |

18,000 |

Bank balance |

4,500 |

||

| Cash on hand |

300 |

||||

| Stock |

4,000 |

||||

| Sundry Debtors |

7,600 |

||||

| Less: Provision |

__380 |

7,220 |

|||

| Plant |

20,000 |

||||

| Closing capital |

24,520 |

Less: Depreciation |

2,000 |

18,000 |

|

| (Balancing figure) | Furniture |

10,000 |

|||

| Less: Depreciation |

1,500 |

8,500 |

|||

|

42,520 |

42,520 |

Statement of Profit or loss for the period ended 31.3.2004

Rs.

Closing capital 24,520

Add: Drawings 10,000

34,520

Less: Additional capital 4,000

Adjusted closing capital 30,520

Less: Opening capital 23,200

Profit made during the year 7,320

Illustration 6:

Ram and Laxman are equal partners in a business in which the books are kept by single entry. On 1.4.2004 their position was as under:

| Liabilities | Rs. | Assets |

Rs. |

| Capital accounts: | Cash in hand |

5,000 |

|

| Ram 2,50,000 | Cash at bank |

15,000 |

|

| Laxman 2,50,000 |

5,00,000 |

Bills receivable |

30,000 |

| Bills payable |

20,000 |

Stock |

1,00,000 |

| Sundry Creditors |

30,000 |

Sundry Debtors |

25,000 |

| Furniture |

1,25,000 |

||

| Plant & Machinery |

2,50,000 |

||

|

5,50,000 |

5,50,000 |

On 31.3.2005 their position was as under:

Rs.

Cash in hand 2,000

Sundry Creditors 35,000

Sundry Debtors 30,000

Bills receivable 26,000

Cash at Bank 10,000

Stock 1,10,000

Bills payable 10,000

Plant & Machinery and furniture are to be depreciated by 10%.

Drawings : Ram 30,000

Laxman 25,000

Ascertain the profit for the year ended 31.3.2005.

Solution:

Calculation of closing capital:

Statement of affairs of Ram & Laxman as on 31.3.2005

|

Liabilities |

Rs. | Rs. | Assets | Rs. |

Rs. |

| Sundry creditors |

35,000 |

Cash in hand |

2,000 |

||

| Bills payable |

10,000 |

Cash at bank |

10,000 |

||

| Sundry debtors |

30,000 |

||||

| Bills receivable |

26,000 |

||||

| Stock |

1,10,000 |

||||

| Closing capital |

4,70,500 |

Plant & Machinery |

2,50,000 |

||

| (Combined capital | Less: Depreciation |

25,000 |

2,25,000 |

||

| ofRam & Laxman) | Furniture |

1,25,000 |

|||

| Less: Depreciation |

12,500 |

1,12,500 |

|||

|

5,15,500 |

5,15,500 |

||||

|

|

|

Statement of profit or loss for the year ended 31.3.2005

| Rs. | |

| Combined closing capital |

4,70,500 |

| Add: Drawings: | |

| Ram 30,000 | |

| Laxman 25,000

Adjusted closing capital

|

__55,000 |

|

5,25,500 |

|

| Less: Combined opening capital |

5,00,000 |

| Profit for the year |

25,500 |