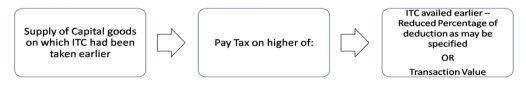

Supply of Capital goods on which ITC already taken :

Please note that there is no saving clause in the event the taxable person entertained a bona fide view as to the non- taxability of certain supplies or availability of an exemption which is later overturned by a superior Court and the demand crystallizes. In this scenario, limitation of availment of input tax credit lands a double blow to this taxable person. That is, not only would GST have been paid on inputs, input services and capital goods on which no credit would have been availed (due to this bonafide view having been entertained) but also, the full extent of the output tax becomes payable (without any relief towards credit that would otherwise have been available) due to the decision of the superior Court. One needs to exercise caution while entertaining a view about non-taxability or exemption. At the same time, it is not permitted to take a hyper-conservative view – where even with the availability of a clear and absolute exemption, the taxable person chooses to pay GST in order to protect credit from the limitation. This option cannot be taken in view of the mandatory nature of such exemptions as clearly stated in explanation to section 11. It could lead to denial of credits as the supply was not taxable!

The difference between ‘taxable person’ and ‘registered person’ is important – they are two deliberately dissimilar phrases used in the law – and credit is allowed u/s 16(1) only to a ‘registered person’ where as u/s 9(1) tax levied is payable by every ‘taxable person’ implying that the liability subsists even if not registered but credit is available only if registered.