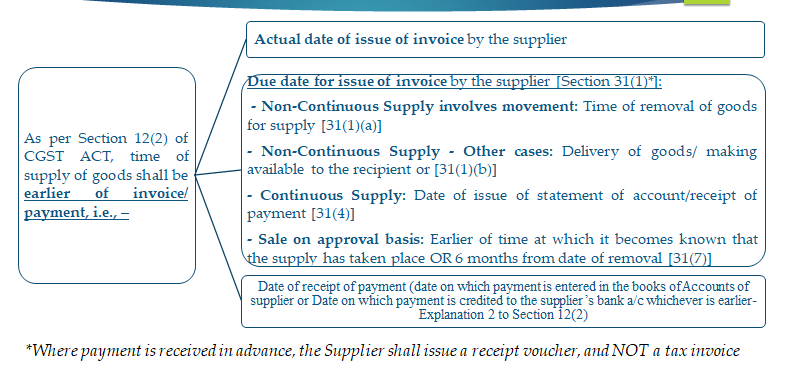

Time of Supply of Goods – Sec 12(2)

- Excess payment of upto Rs. 1000/- is received in respect of any invoice

ØTime of supply shall at option of the supplier is date of issue of invoice in respect of such excess amount. (Proviso to Sec 12(2))

- No tax on advance received against the supply of goods

As per Notification No. 40/2017- CT dated 13-10-2017, suppliers of goods having aggregate turnover of upto Rs 1.50 crores in the last year or current year have been exempted to pay tax upon receipt of advance (w.e.f 13-10-2017) as the time of supply in such cases would be the date of invoice or due date of issue of invoice in light of Clause (a) of Section 12(2). Subsequently this exemption has been extended w.e.f. 15-11-2017 to all tax payers vide Notification No 66/2017-CT dated 15-11-2107.

This benefit is not available to person covered under Composition Scheme.

In summary, the taxability of the consideration received in advance in respect of goods for non-composition dealers would be as follows:

|

Period |

Taxability of consideration received in advance

|

|

|

Aggregate turnover less than Rs 1.50 crores |

Aggregate turnover more than Rs 1.50 crores |

|

|

01.07.2017 to 12.10.2017 |

Taxable |

Taxable |

|

13.10.2017 to 14.11.2017 |

Not taxable |

Taxable |

|

15.11.2017 and onwards |

Not taxable |

Not taxable |