Treatment of Goodwill on Admission

Whenever a new partner is admitted, he is generally expected to pay cash to old partners for his share of goodwill for the right he acquires to share in profits of the firm in future. Strictly, such a payment should be made only when there are super profits but in actual practice, some premium or goodwill may have to be paid by the new partner on his admission even when the business of the firm is not unusually profitable and consequently there are no super profits. The payment is made to the old partners for the sacrifice they make on their shares of profits for future. It is not necessary that the new partner must bring cash for his share of goodwill, only adjustment may be made for goodwill. The various alternative courses for the accounting treatment of goodwill on admission of a partner are as follow

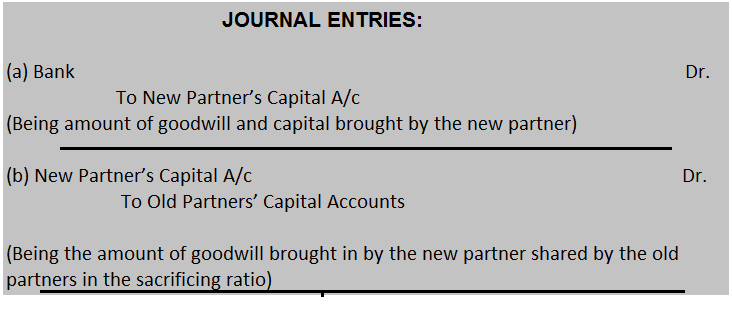

(i) When the incoming partner brings in the required amount of goodwill in cash and this amount is retained in the business:

–The amount of goodwill brought in by the incoming partner along with his share of capital is credited to his capital account and

–Then this amount of goodwill is debited to the new partner’s capital account and credited to the old partners’ capital account in the sacrificing ratio.

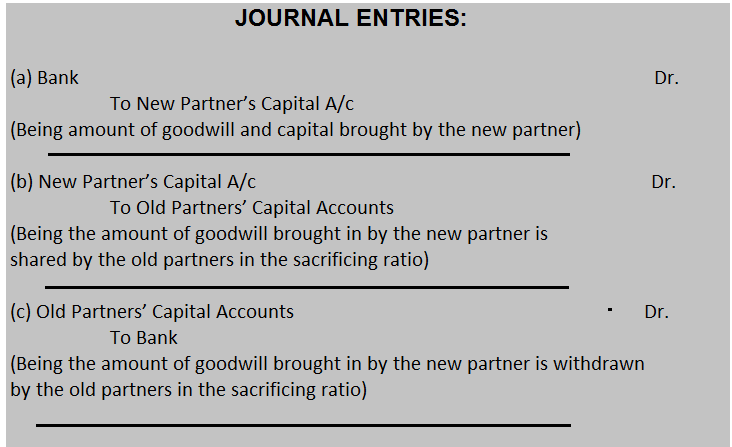

(ii) When the required amount of goodwill brought in by the new partner in cash is immediately withdrawn by the old partners

In this case the amount of goodwill is withdrawn by the partners in the sacrificing ratio and the entry for withdrawal will be:

(iii) Where the new partner pays amount of goodwill privately to the old partners

In this case, no entry is passed in the books of the firm. The amount to be paid to each partner should be calculated as per the profit-sacrificing ratio.

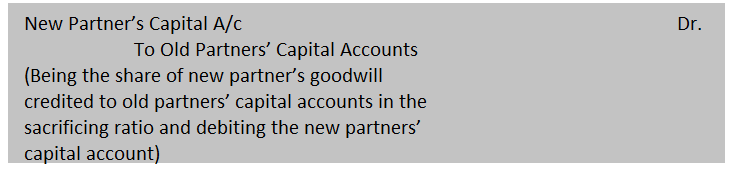

(iv) Where the partner is unable to bring anything for goodwill

In this case, the value of goodwill should not be raised in the books. Since it is inherent goodwill, it is preferable that such value of goodwill should be adjusted through partners’ capital accounts. The new partner’s capital is debited with his share of goodwill and the amount is credited to old partners’ capital accounts in the ratio in which they make sacrifice of profits. The journal entry will be:

(v) When the new partner brings a portion of the required amount of goodwill

In this case, the amount brought in by the new partner will be shared by the old partners in the sacrificing ratio and the portion of amount of goodwill not brought in by the new partner is adjusted through the capital accounts of partners by debiting, new partner’s capital account with the amount and crediting the old partners’ capital accounts in their sacrificing ratio.

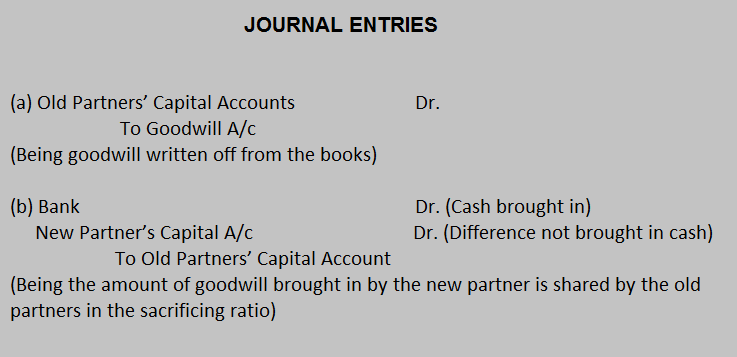

(vi) When the goodwill is already appearing in the books of accounts:

When the goodwill is already appearing in the firm’s books, first of all goodwill is to be written off from the books by debiting old partners’ capital accounts in their profit sharing ratio and crediting goodwill account. Then new partner’s capital account is debited with his difference in share of goodwill not brought in cash and this amount is credited to old partners’ capital accounts in sacrificing ratio.

(vii) Hidden goodwill:

Sometime the value of goodwill has to be inferred from the agreement of capitals and profit sharing ratio among the partners.

(a) Suppose, A and B share profits in the ratio 2:1 and their capitals stand at Rs.20,000 and Rs.10,000 and they admit C who brings Rs.14,000 and is given 1/4th share in future profits. Now C’s capital should be 1/4th of the total capital.

For 1/4th share, the capital of C =Rs.14000

Therefore, total capital of the firm should be = Rs.56,000

Total capital of A, B and C = Rs.20,000 + Rs.10 000 +Rs.14,000 =Rs.44,000

Value of Goodwill = Total Estimated Capital- Actual Capital

Rs. 56,000- Rs.44,000 = Rs.12,000

(b) Suppose, A and B form partnership agreeing to share profits equally and they contribute Rs.12,000 and ` 9,000 respectively, it can be inferred that a goodwill of Rs.3,000 attaches to A.